Mobile App for Document and Data Security Harnessing Blockchain Technology

Mobile security app

Mobile App Data Security: Harnessing Blockchain Technology for Secure Document Management

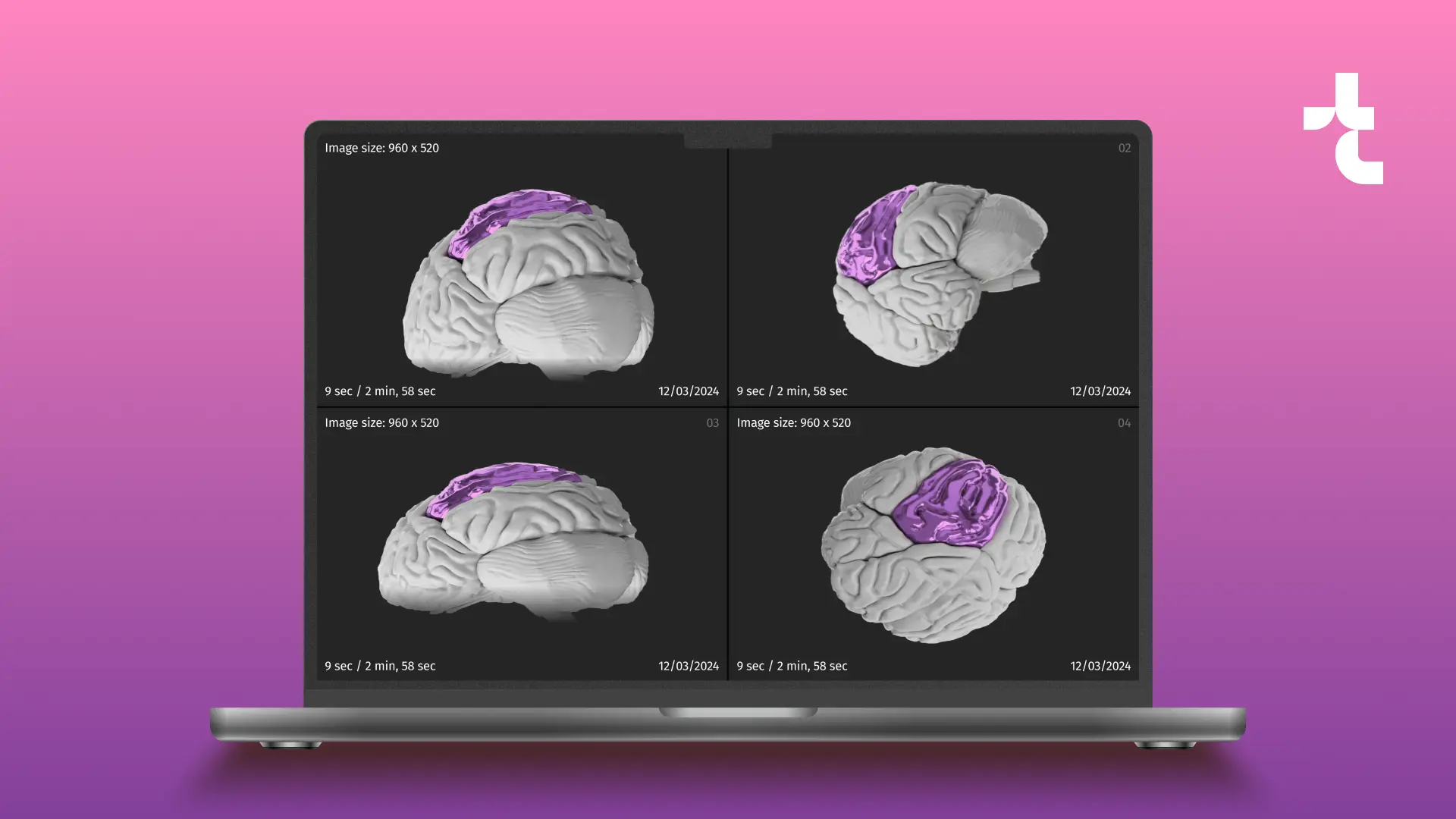

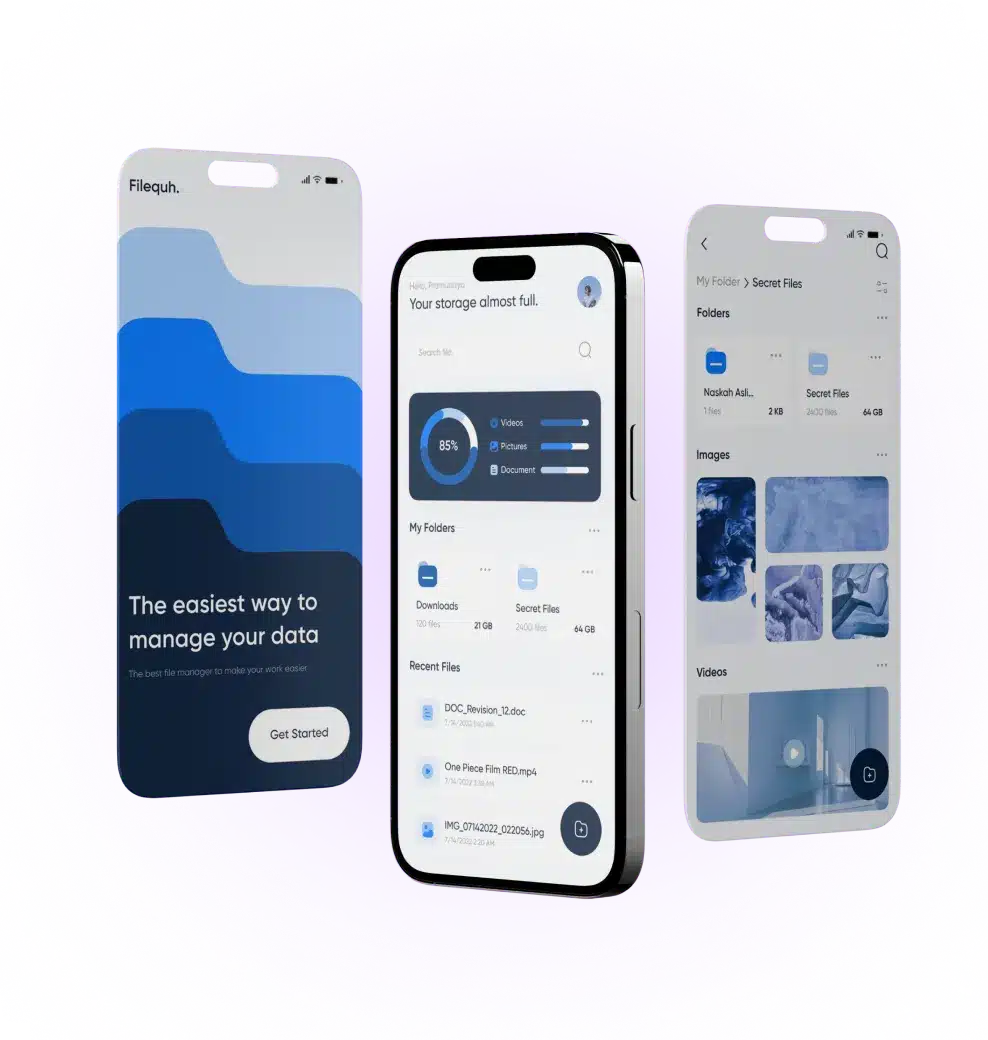

The team developed a document and data management mobile app on iOS and Android platforms for a large blockchain technology company.

#Blockchain

#DataManagement

#Security

Client*

A leading blockchain technology company that has offered innovative solutions for businesses of all sizes since 2017. While they were managing the back-end development, the company assigned front-end development to our team that had the necessary expertise.

Project in numbers

2019 – Ongoing

now supporting and updating the product

7 specialists

Team involved in the project

industry

Security

solution

Mobile app for document management

1 x Project Manager

4 x Frontend Developers

1 x UI/UX Designer

1 x QA Engineer

Challenge

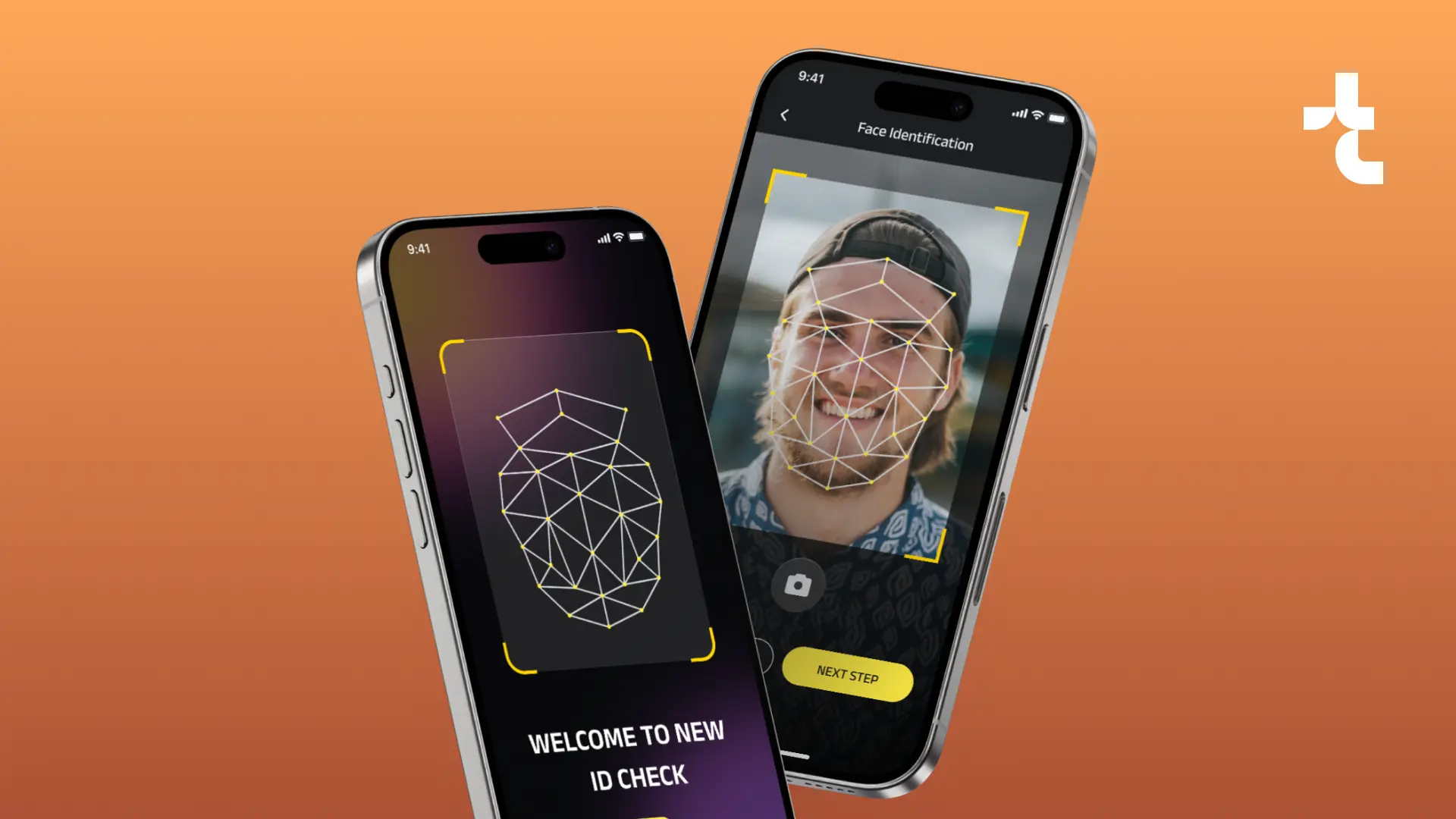

The main objective is to launch a tool for reliable storage and verification of documents being stored within a blockchain system.

Related objectives

Establish workflow with client’s back-end team

Define milestones and roadblocks in the delivery process

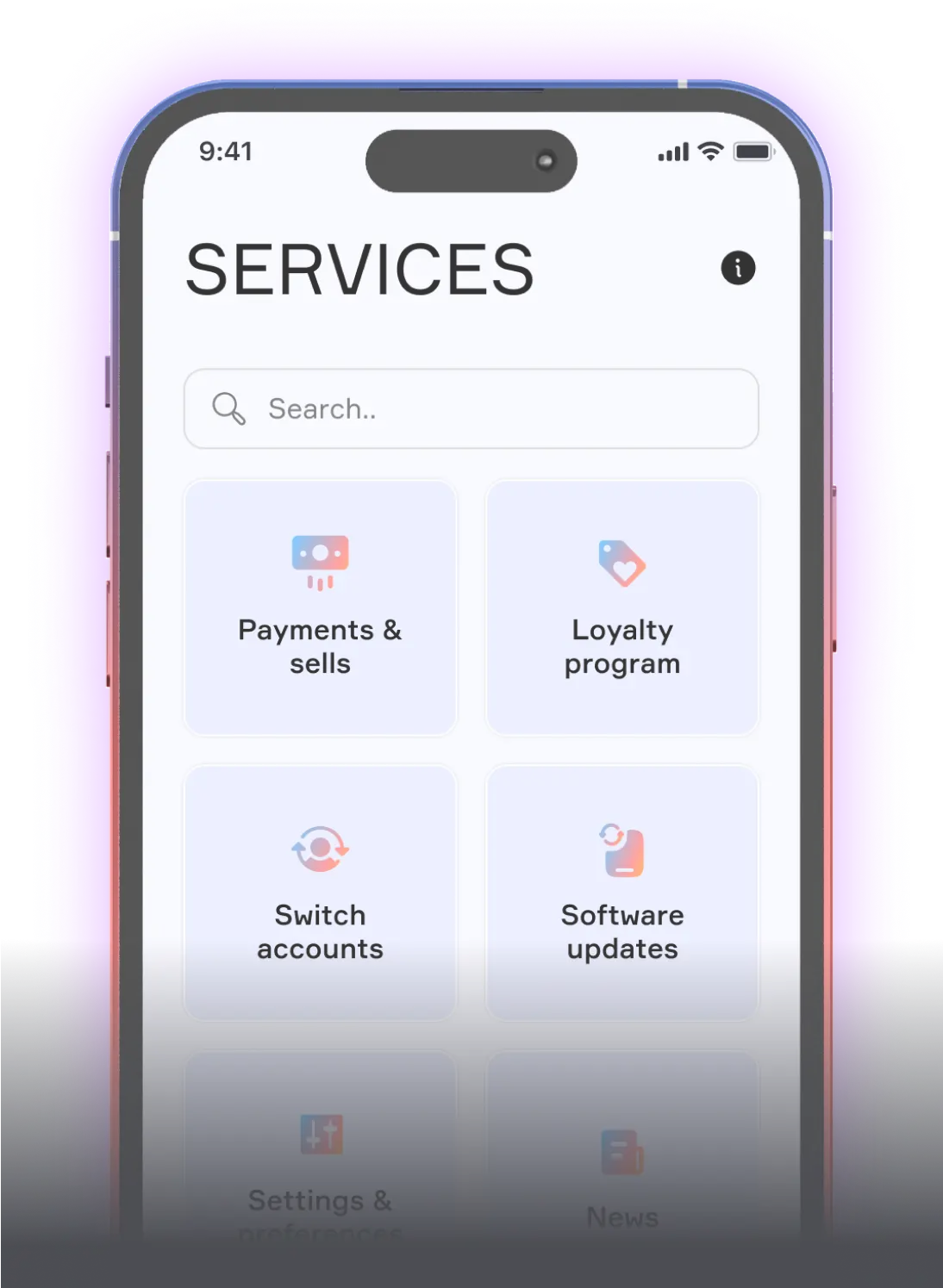

Implement several services in both iOS and Android

Solution & functionality

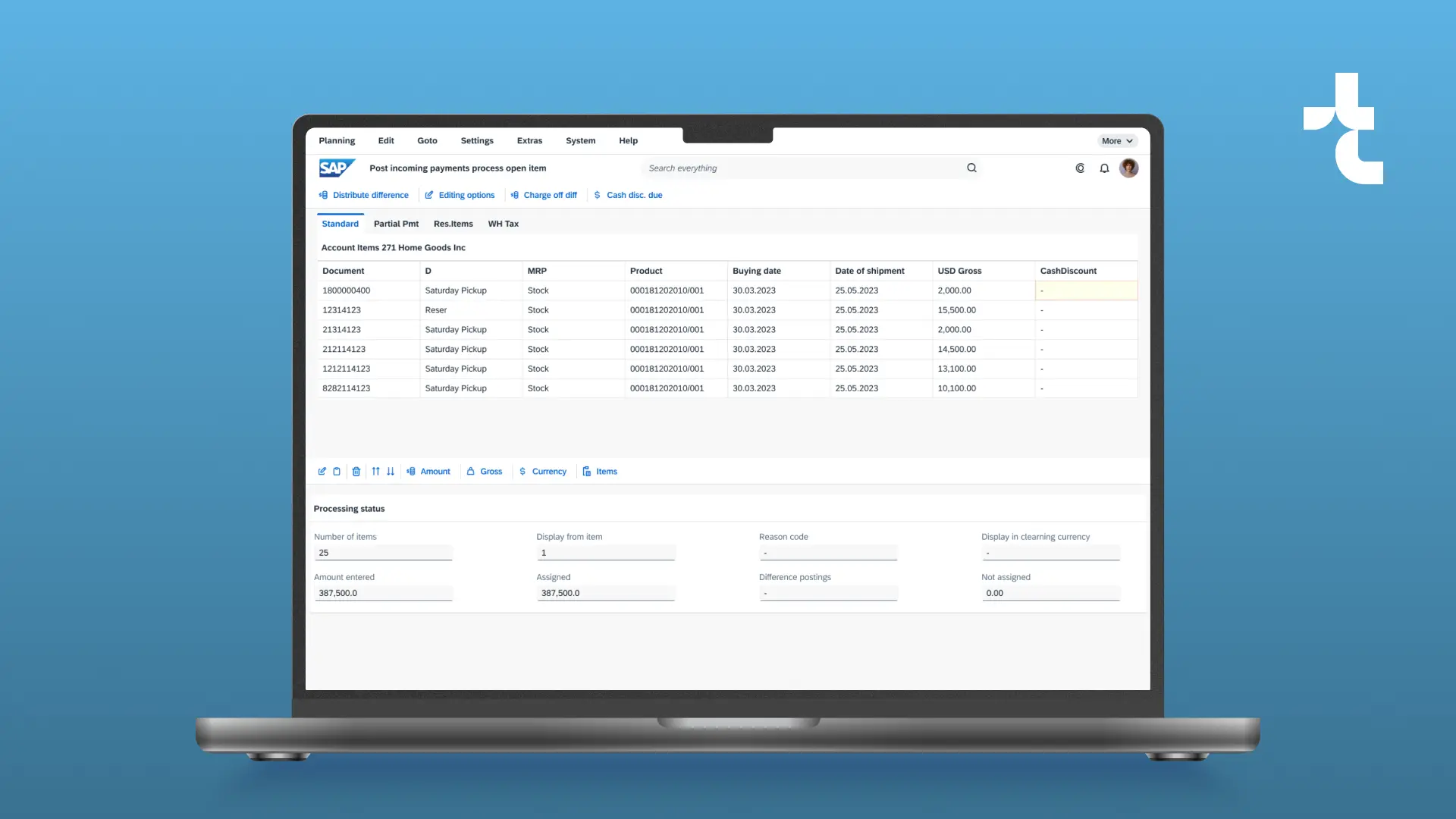

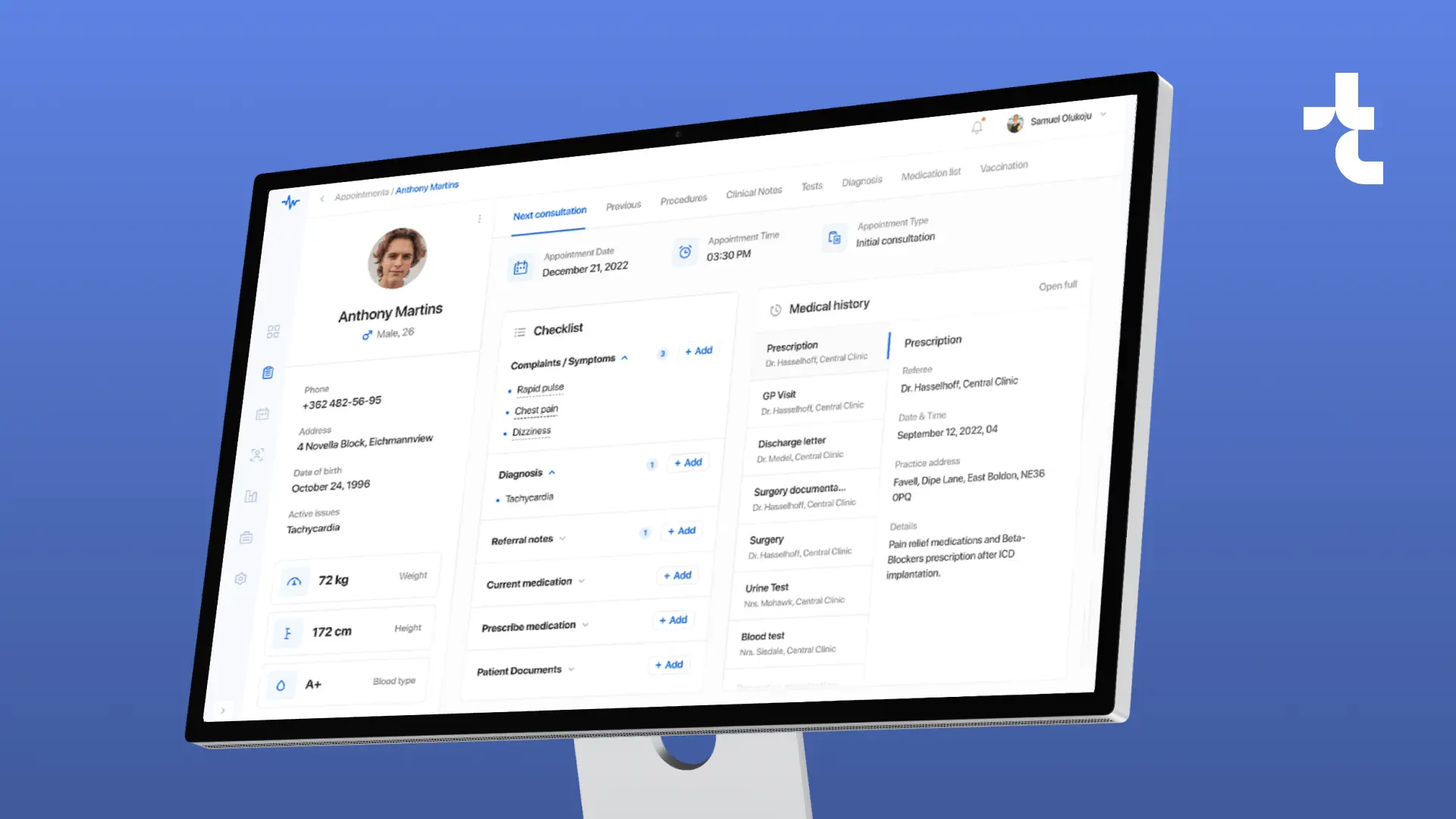

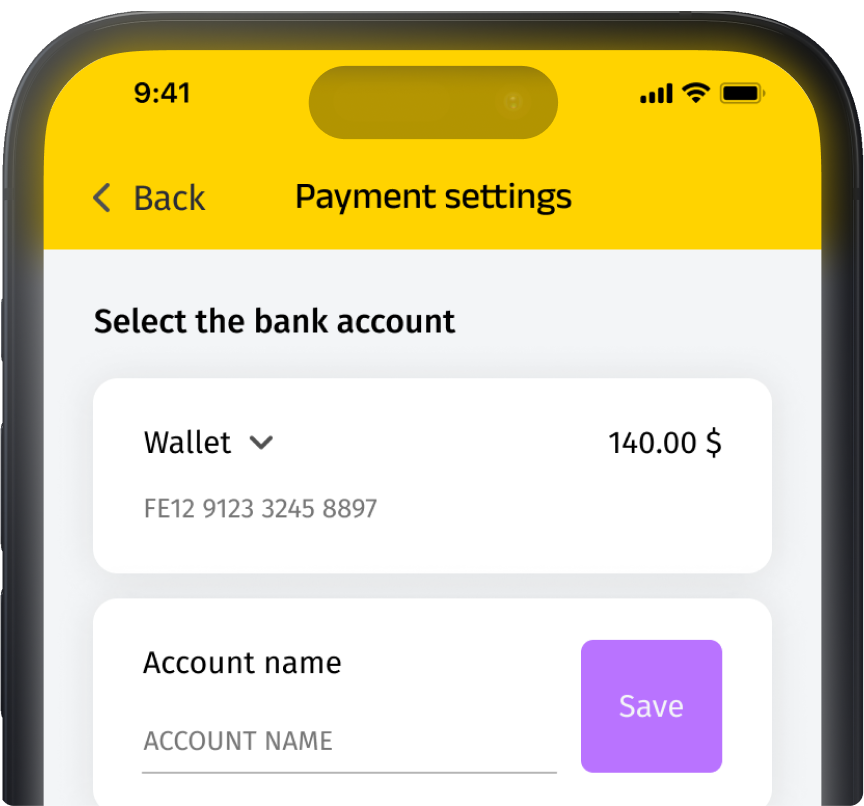

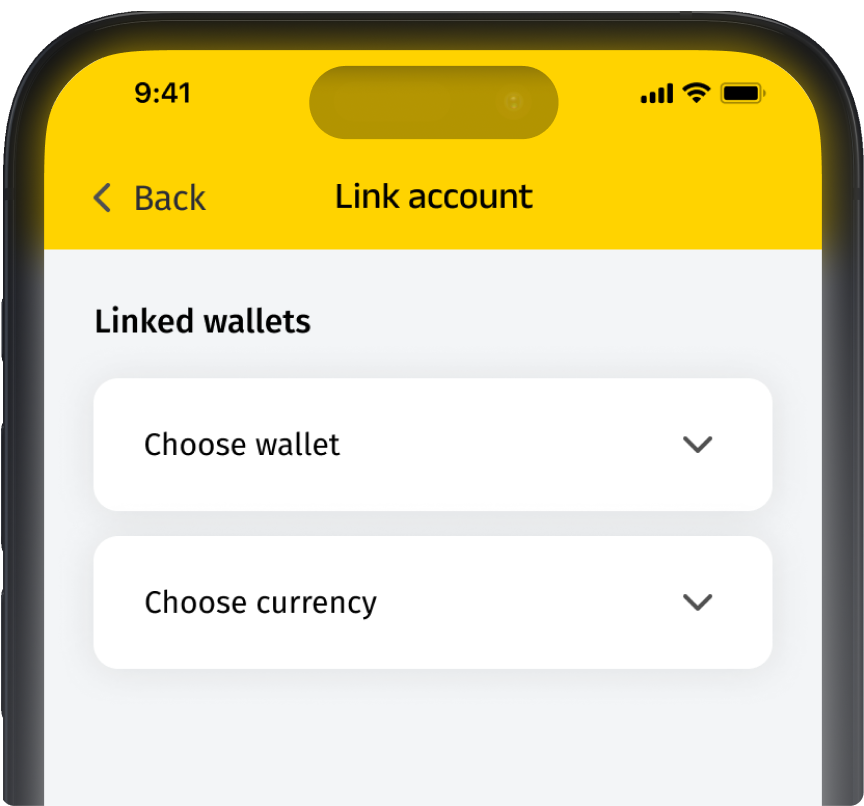

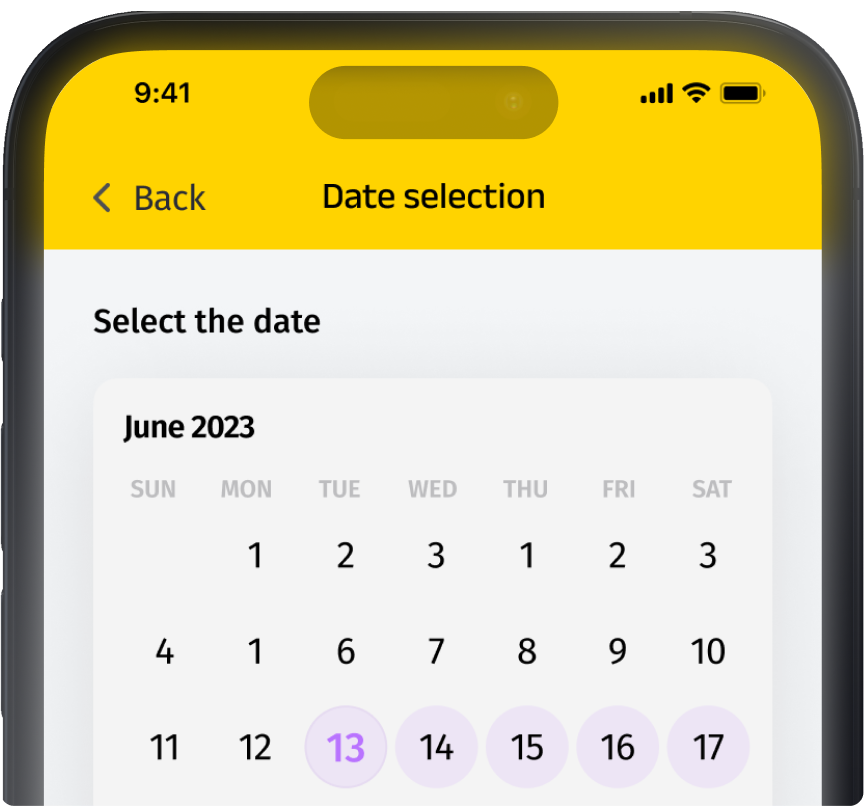

Our professionals enhanced the client’s in-house team from the front-end development side. Together we launched an efficient solution on iOS and Android platforms for secure document management.

Generation of new files

Verification with a digital signature

Uploading different file formats

Validation and timestamping

Sharing with ID-tags

Bookmarking

Results and business value

The collaboration of client’s and our teams resulted in a convenient mobile app for managing documents and data through blockchain technology. The final product offers swift, user-friendly remote document sharing and effective data validation.

Active users

Passive users

Customer satisfaction

Benefits for client

The client side of the application developed by our team received exceptional feedback from both end users and the client, resulting in complete customer satisfaction. The application is available on Google Play and App Store. Users can get Premium access with all functionality with usual payment methods and cryptocurrency.

We work closely with the client collaborating on various other projects. Furthermore, we are actively enhancing the mobile application’s functionality and updating the solution architecture to meet evolving requirements.

Related cases

Need assistance with a software project?

Whether you're looking for expert developers or a full-service development solution, we're here to help. Get in touch!

What happens next?

An expert contacts you after thoroughly reviewing your requirements.

If necessary, we provide you with a Non-Disclosure Agreement (NDA) and initiate the Discovery phase, ensuring maximum confidentiality and alignment on project objectives.

We provide a project proposal, including estimates, scope analysis, CVs, and more.

Meet our experts!

Viktoryia Markevich

Relationship manager

Samuel Krendel

Head of partnerships