Telehealth Solution: 5-7% Boost in Financial Results

Telehealth Solution: 5-7% Boost in Financial Results

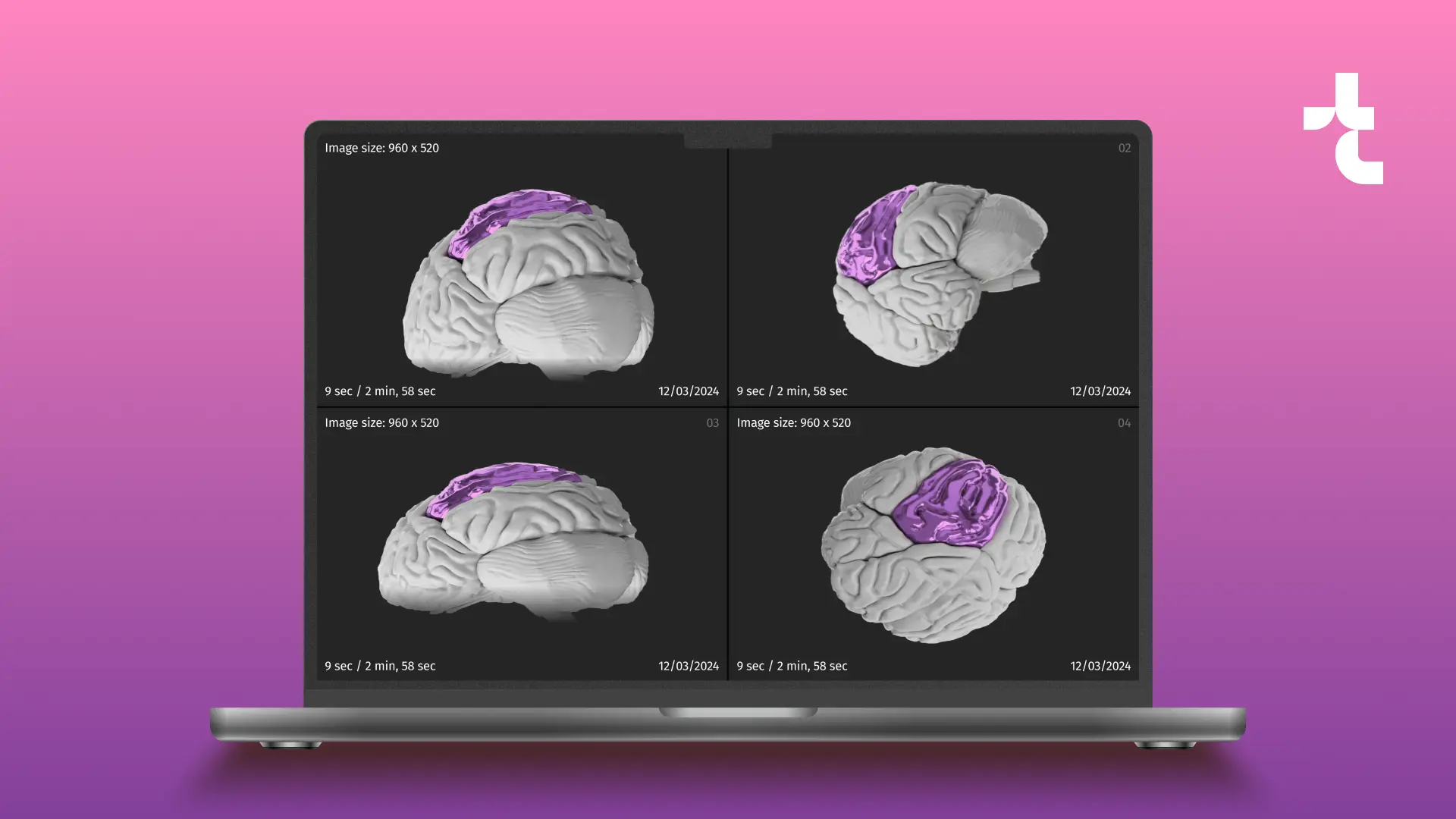

Timspark addressed the client’s need for telehealth app development and created native iOS and Android applications, integrating them into the SaaS healthcare environment.

#Telehealth

#Mobile

#iOS #Android

Client*

Project in numbers

Team involved in the project

2 x iOS Developers

Challenge

The main goal was to create a telehealth solution for iOS and Android platforms that would work seamlessly with the current telehealth web platform in the SaaS healthcare software system.

Related objectives

Solution & functionality

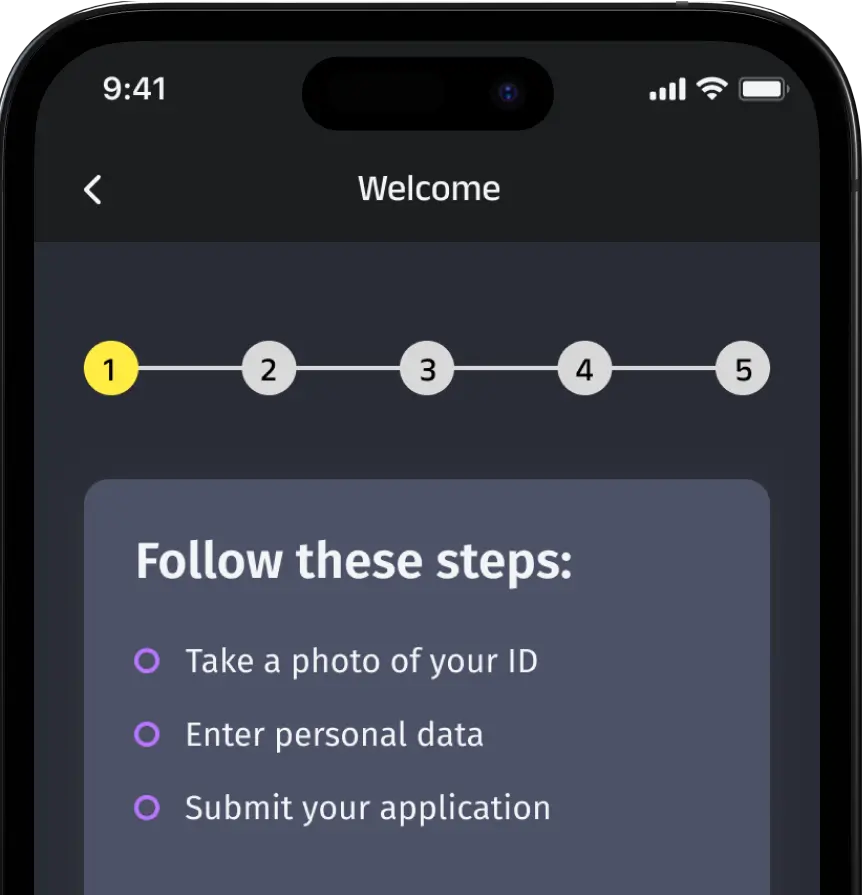

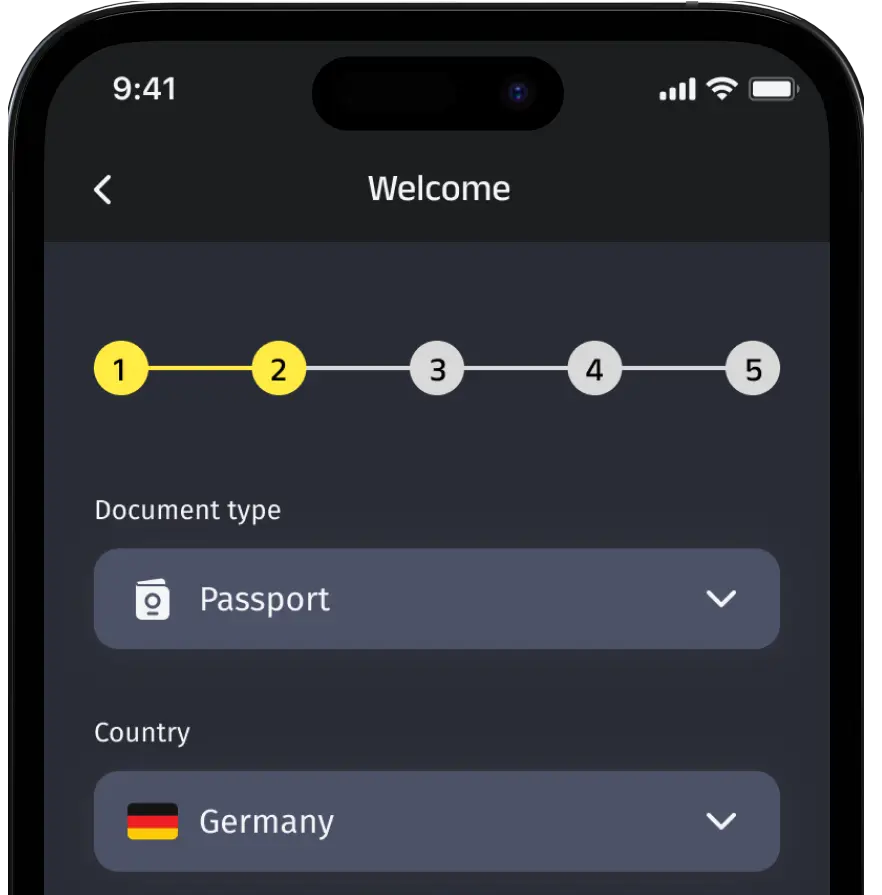

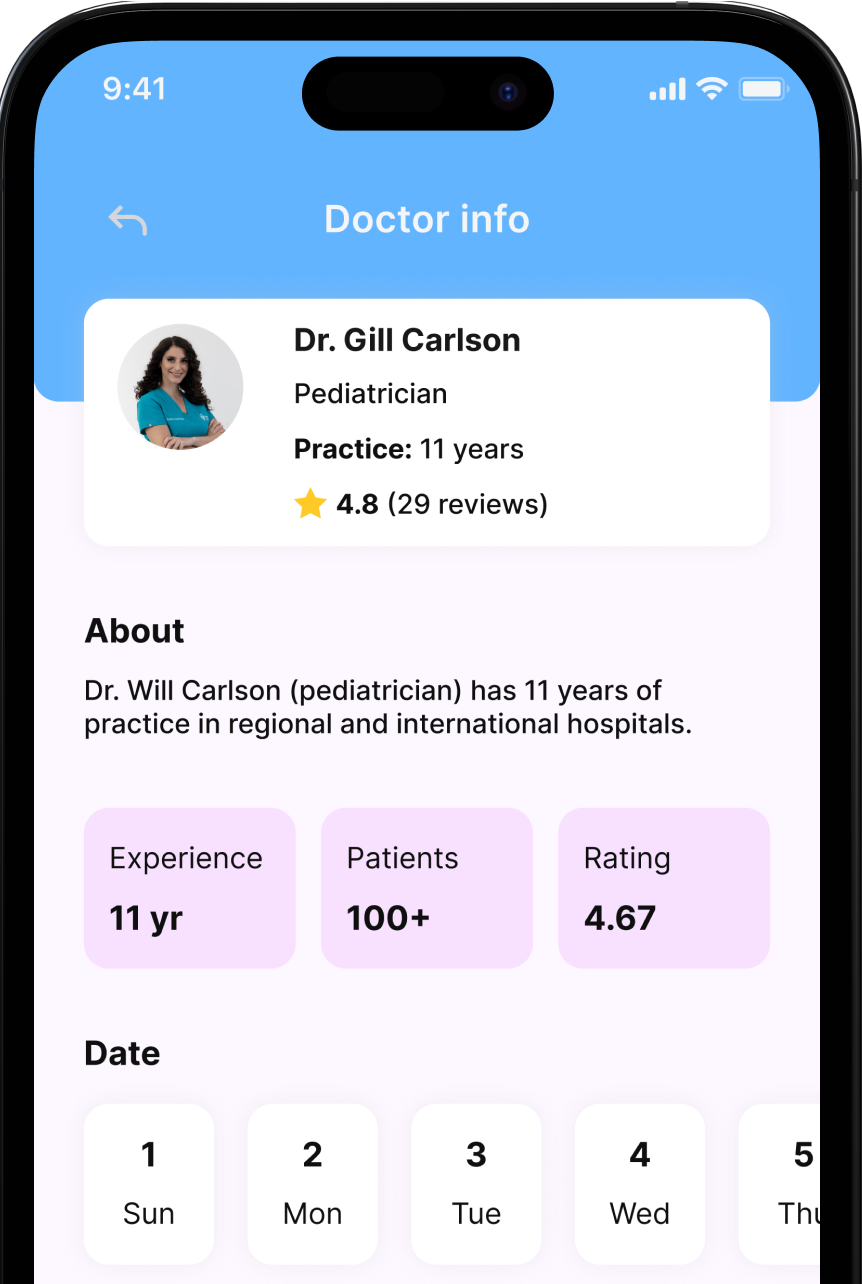

Patient module

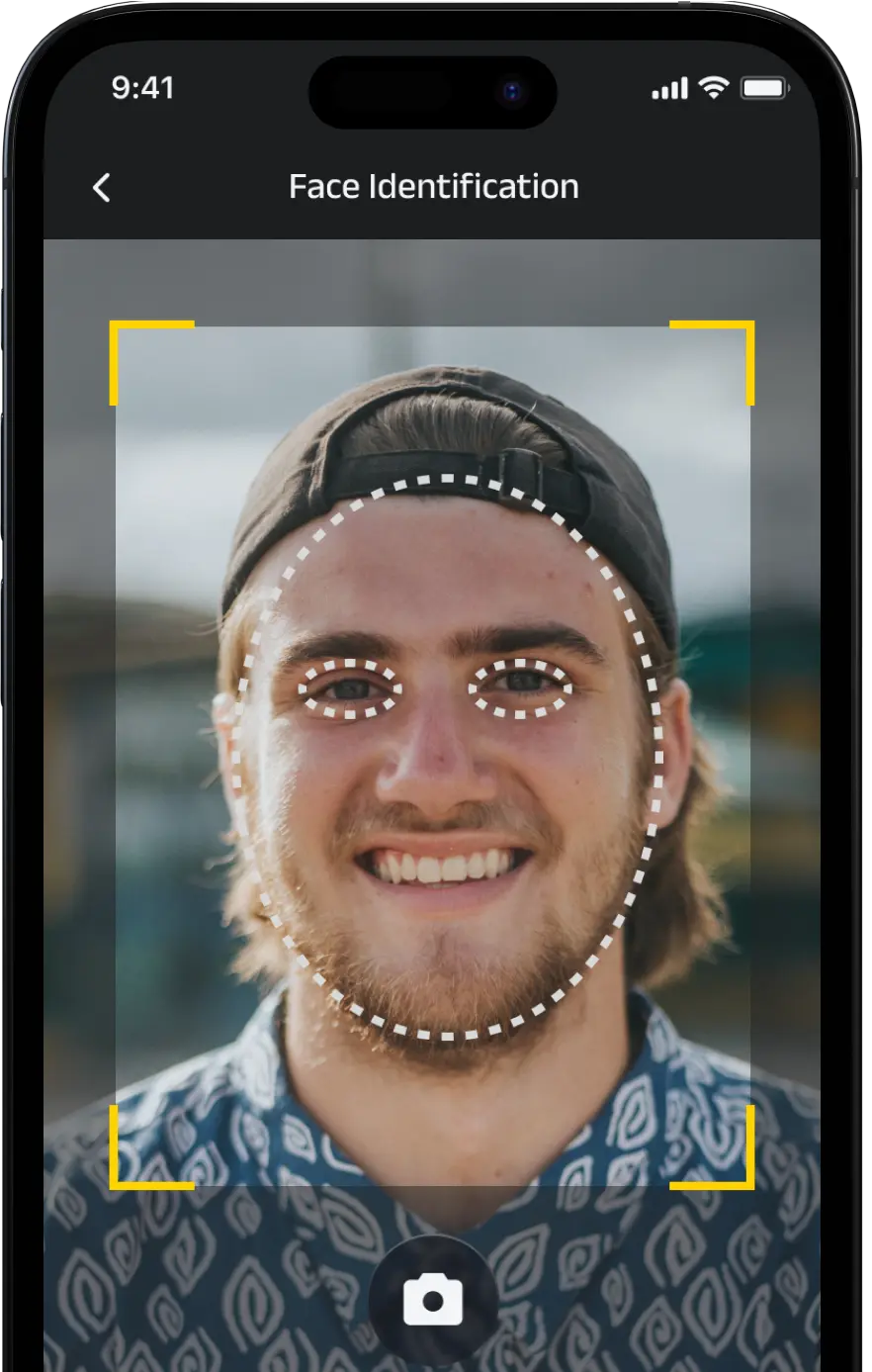

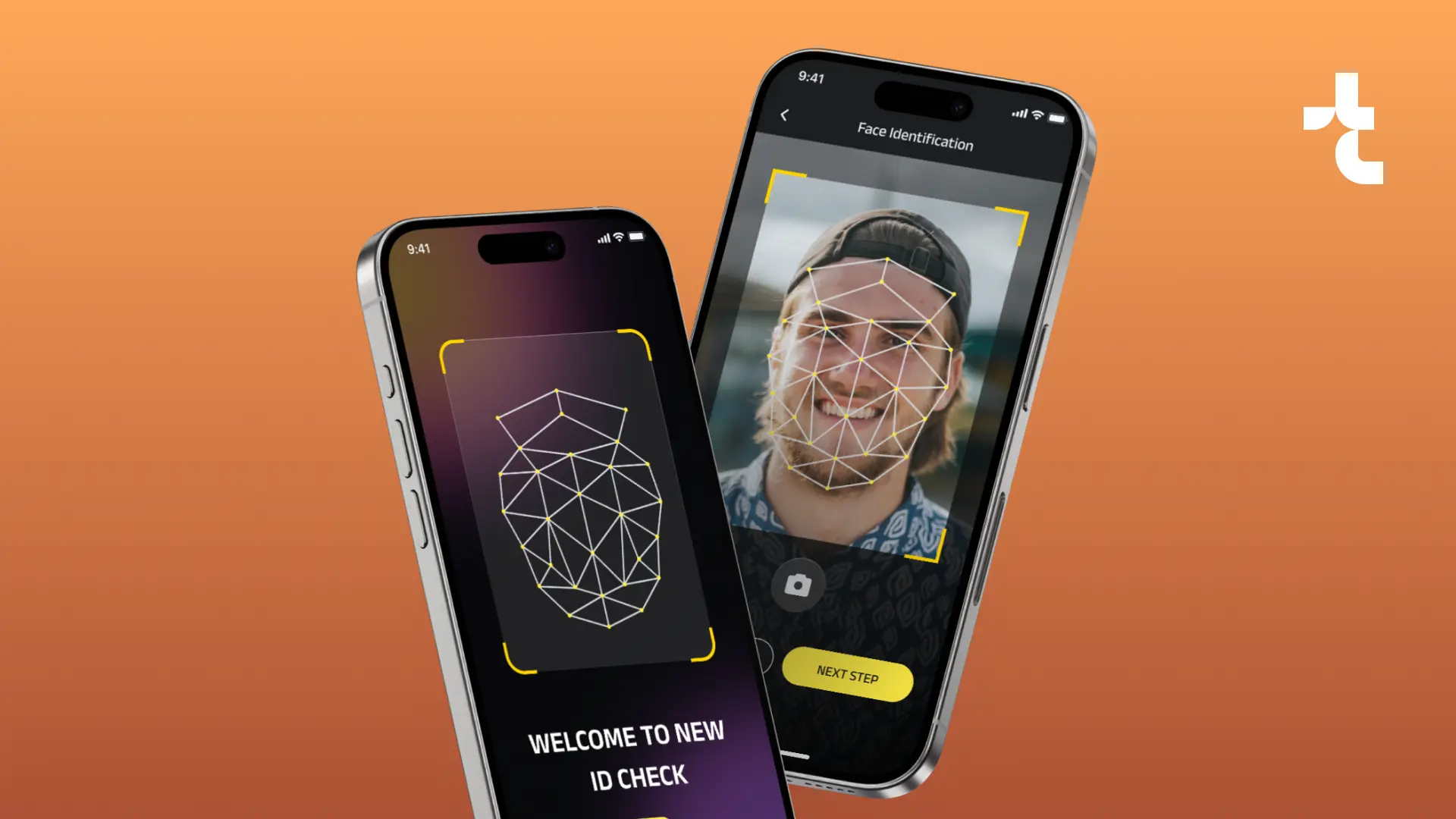

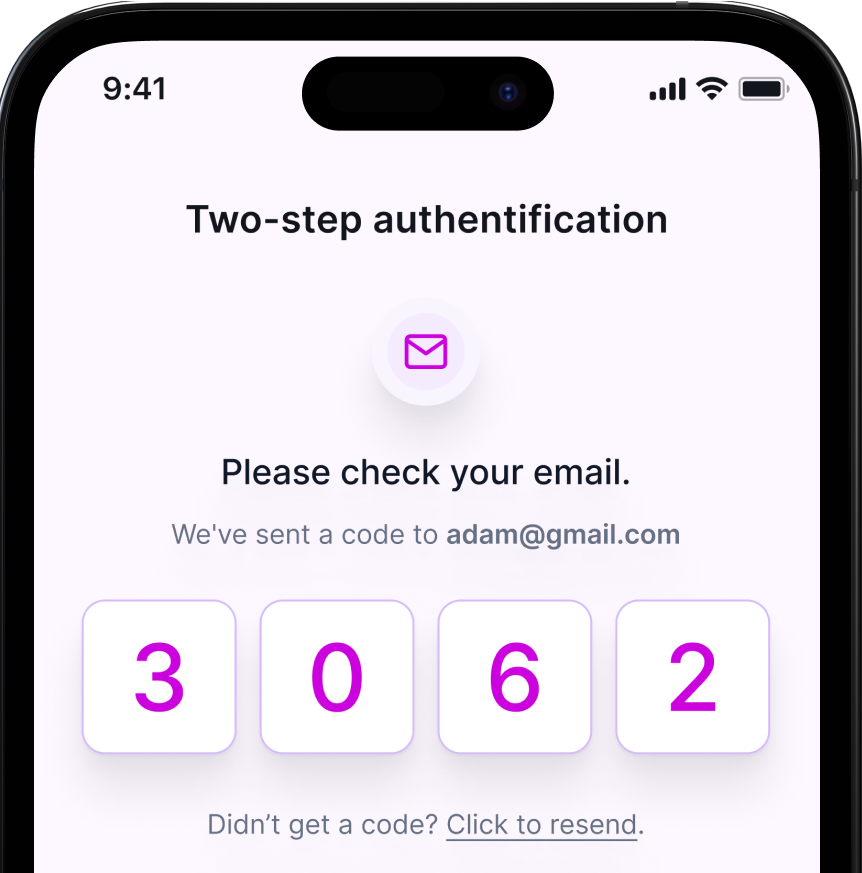

Security

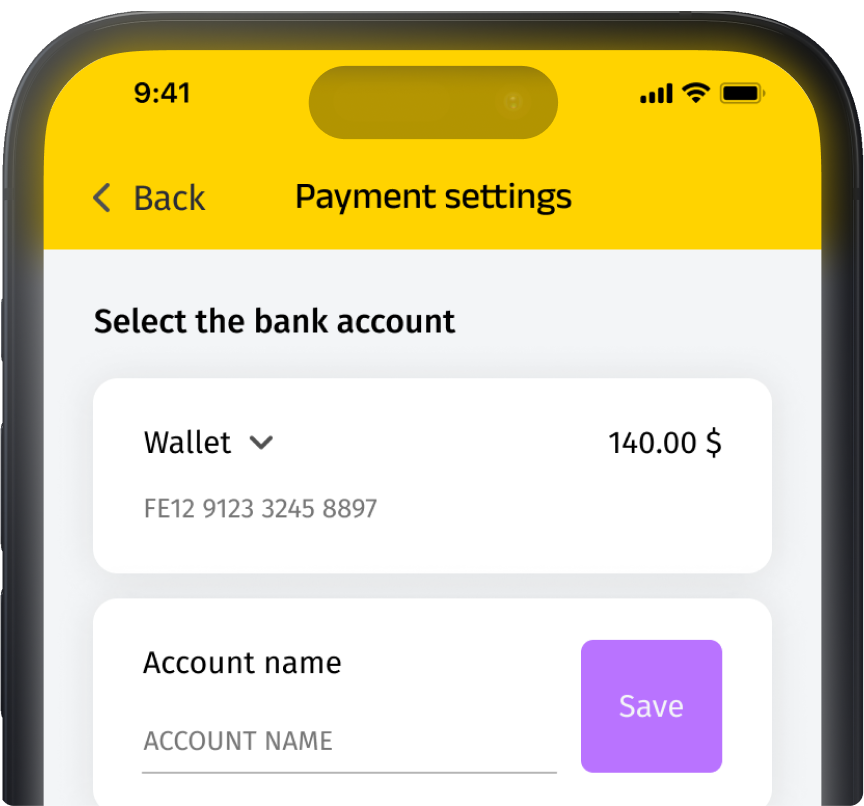

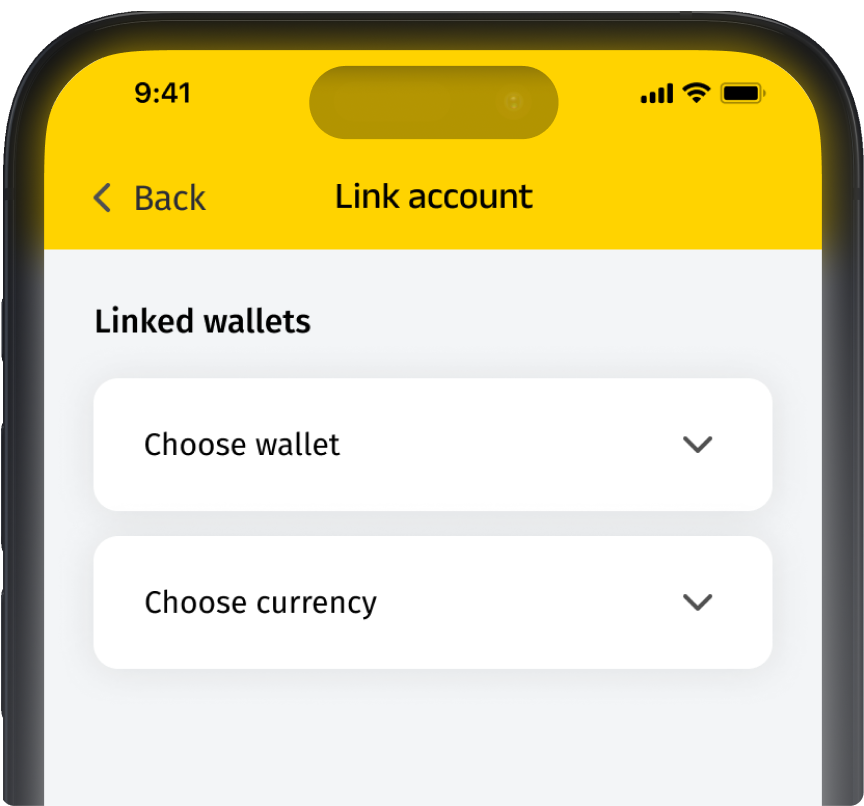

Personalization features

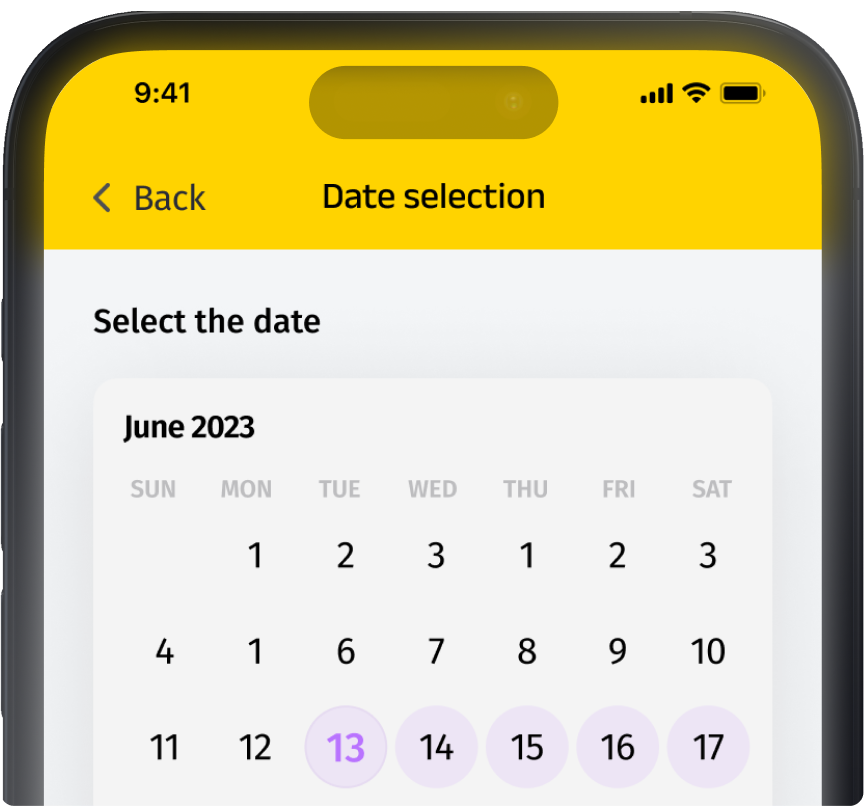

Easy scheduling

Multimedia integration

For doctor-patient consultations, the telehealth solution offers video calls. All electronic appointments are securely recorded and saved in a HIPAA-compliant cloud. When necessary, participants can exchange text messages and multimedia content. After the e-visit, patients are encouraged to give feedback and evaluate the doctor’s performance. Ultimately, the doctor devises a treatment plan, schedules necessary lab tests, prescribes required medications and organizes the next appointment.

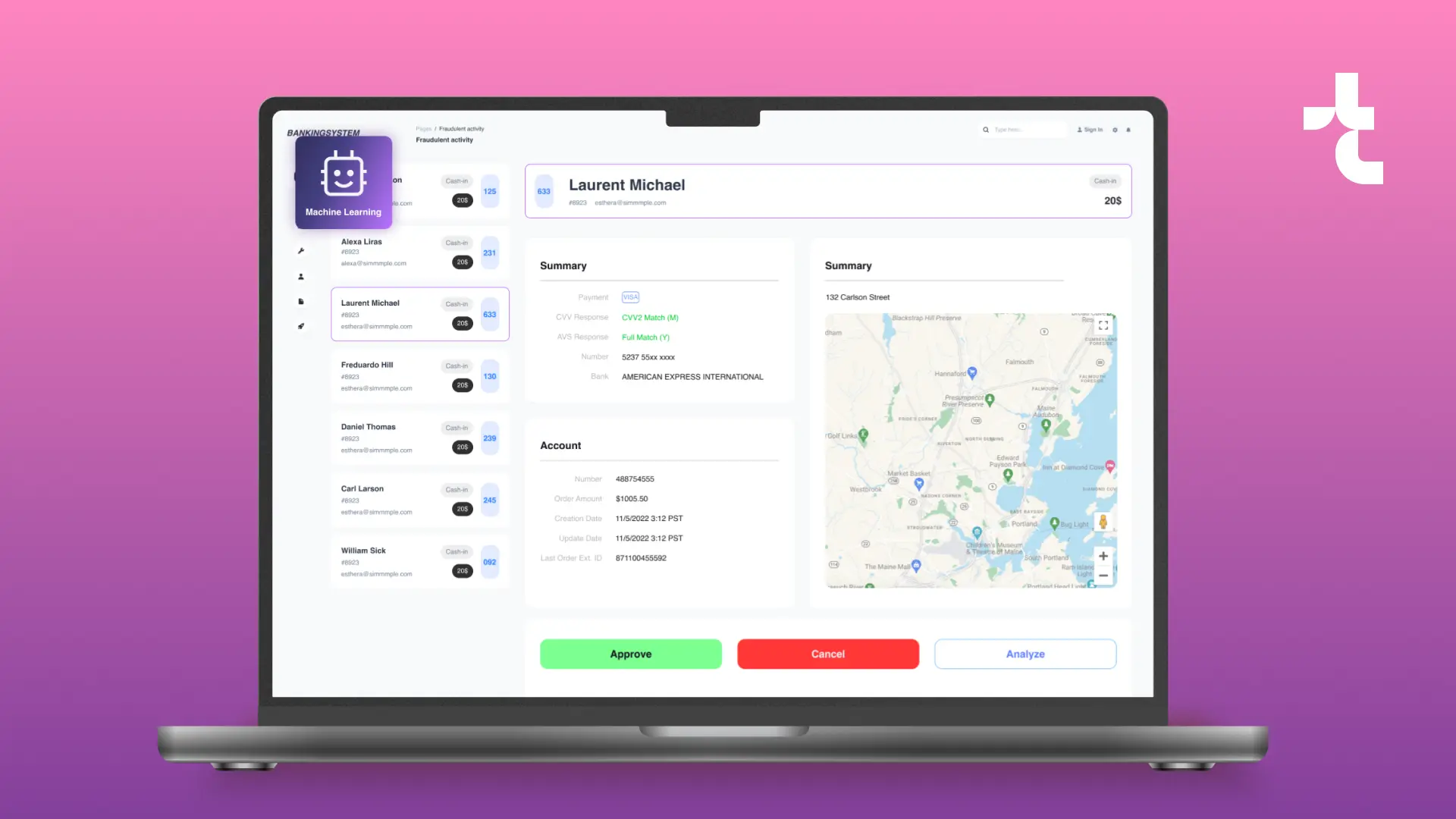

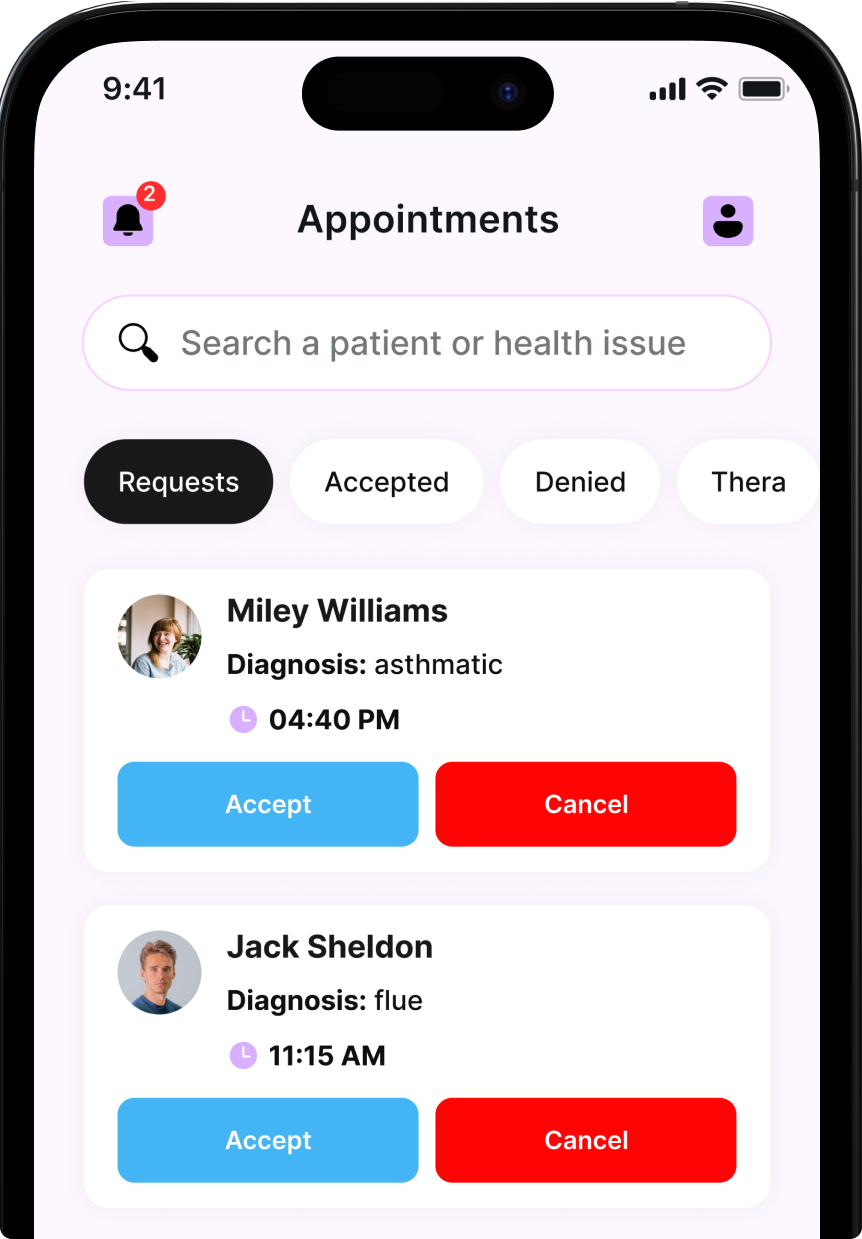

Physician module

Functionality for physicians and the administrative staff

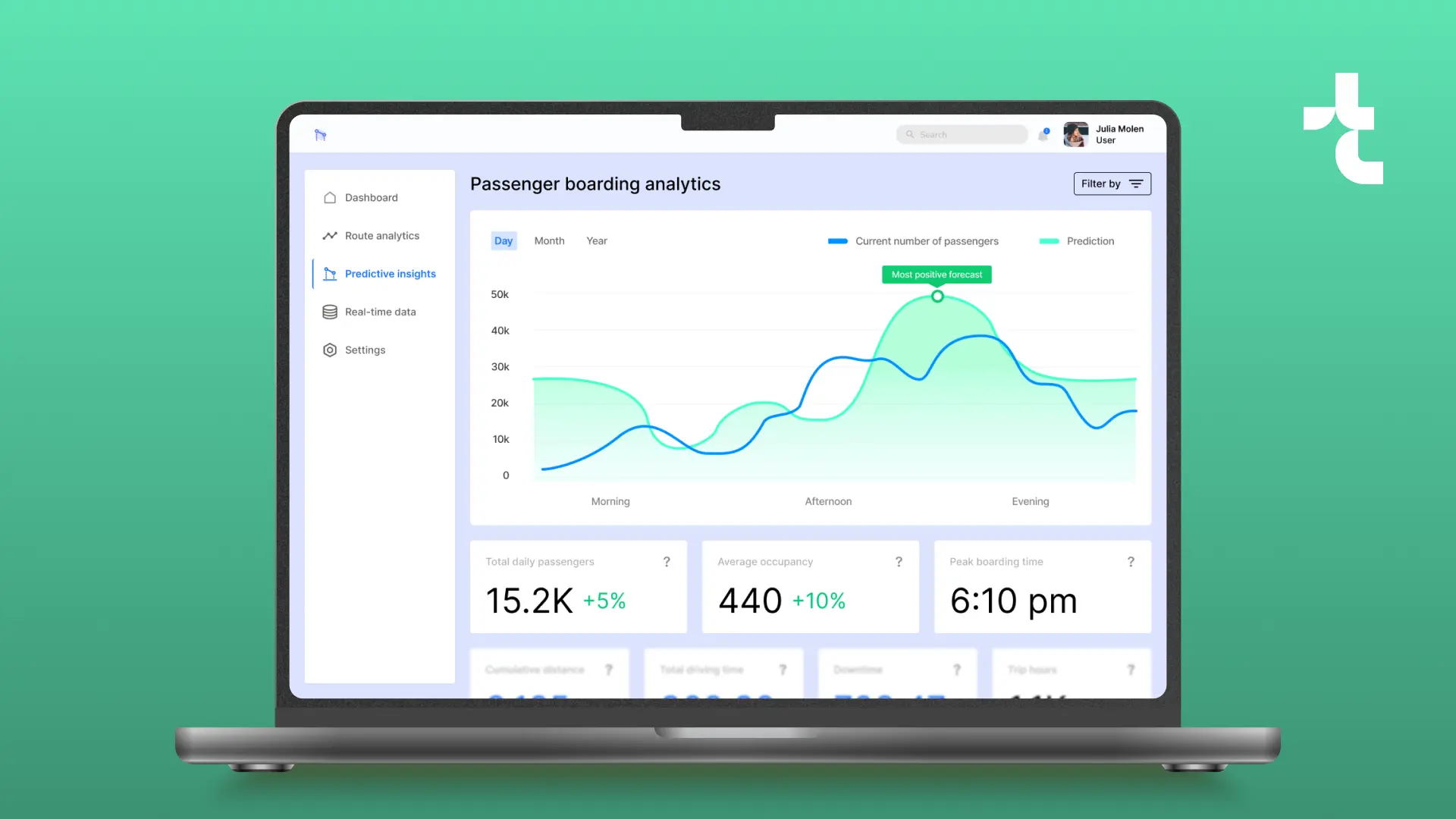

Results and business value

HIPAA compliance and secure PHI

Reduced costs for healthcare delivery

Expected 5-7% boost in economic results

Related cases

Need assistance with a software project?

Whether you're looking for expert developers or a full-service development solution, we're here to help. Get in touch!

What happens next?

An expert contacts you after thoroughly reviewing your requirements.

If necessary, we provide you with a Non-Disclosure Agreement (NDA) and initiate the Discovery phase, ensuring maximum confidentiality and alignment on project objectives.

We provide a project proposal, including estimates, scope analysis, CVs, and more.

Meet our experts!

Viktoryia Markevich

Relationship manager

Samuel Krendel

Head of partnerships