Travel Management Software That Automated 83% of Bookings

Travel Booking Software for Automated Bookings

Travel Management Software That Automated 83% of Bookings

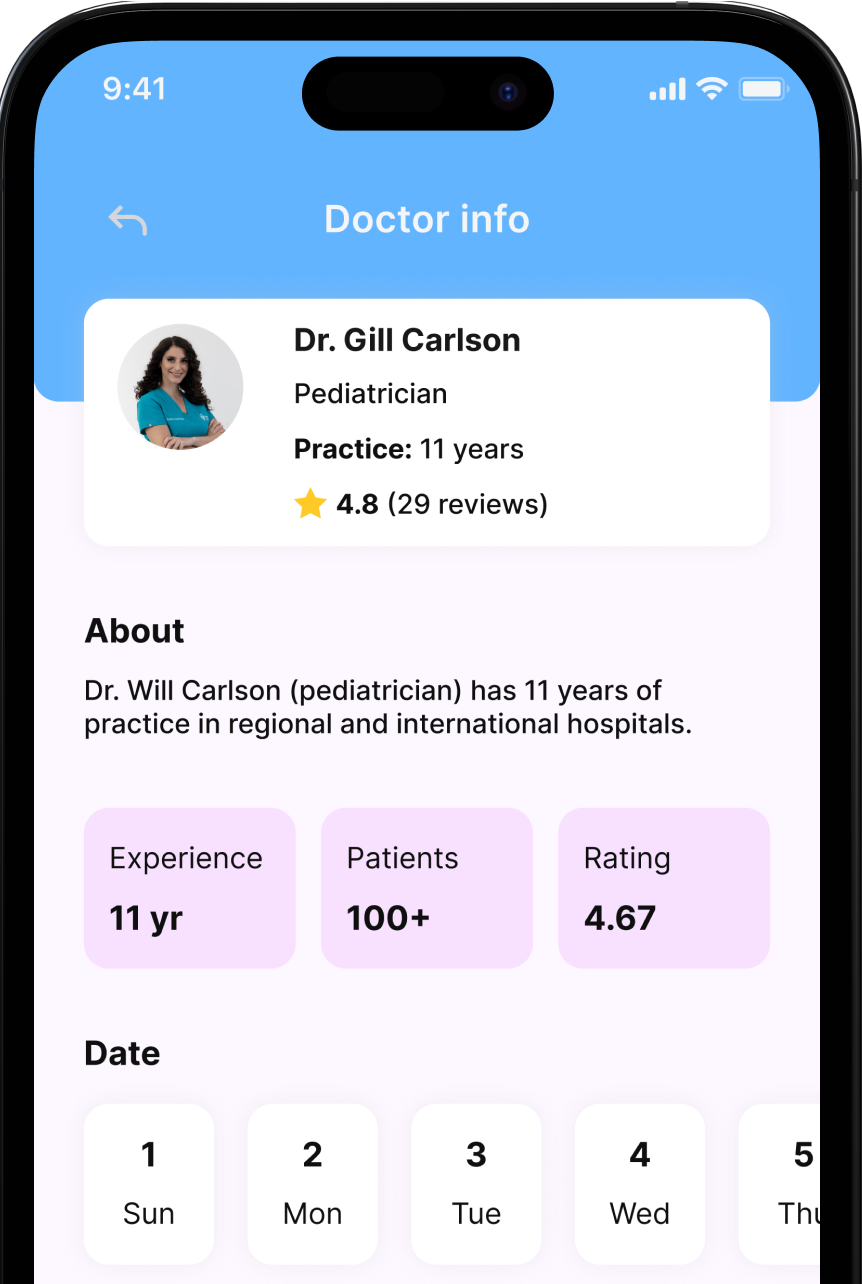

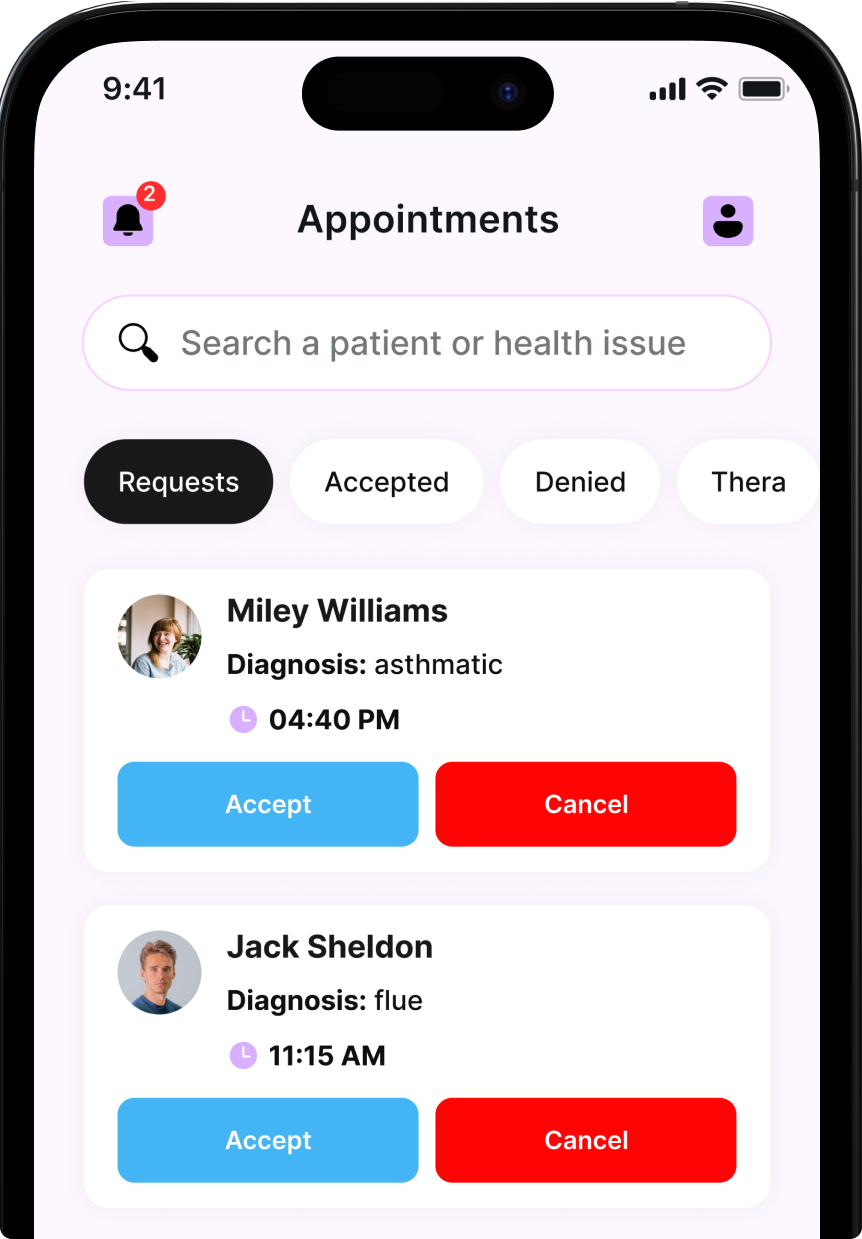

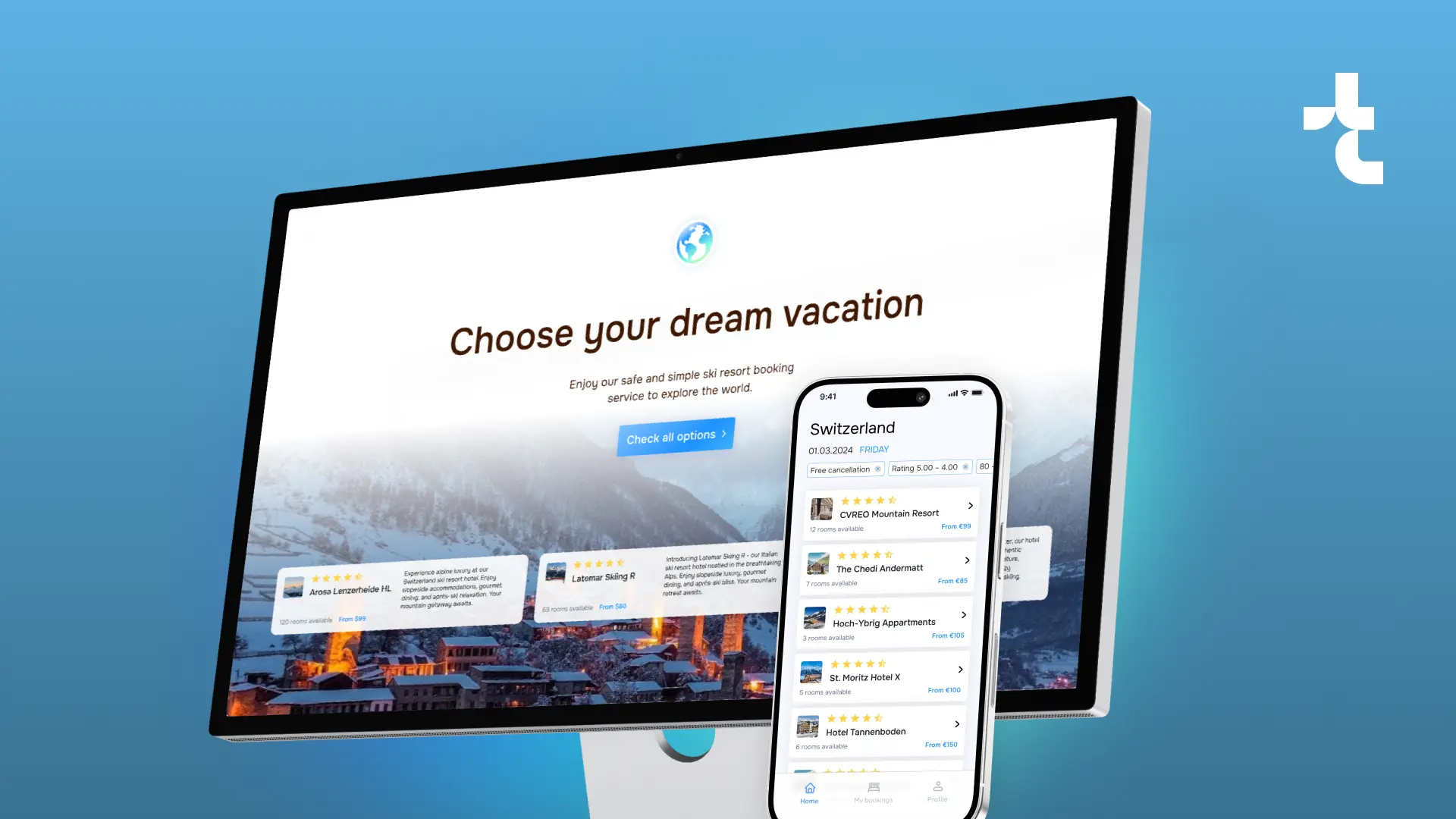

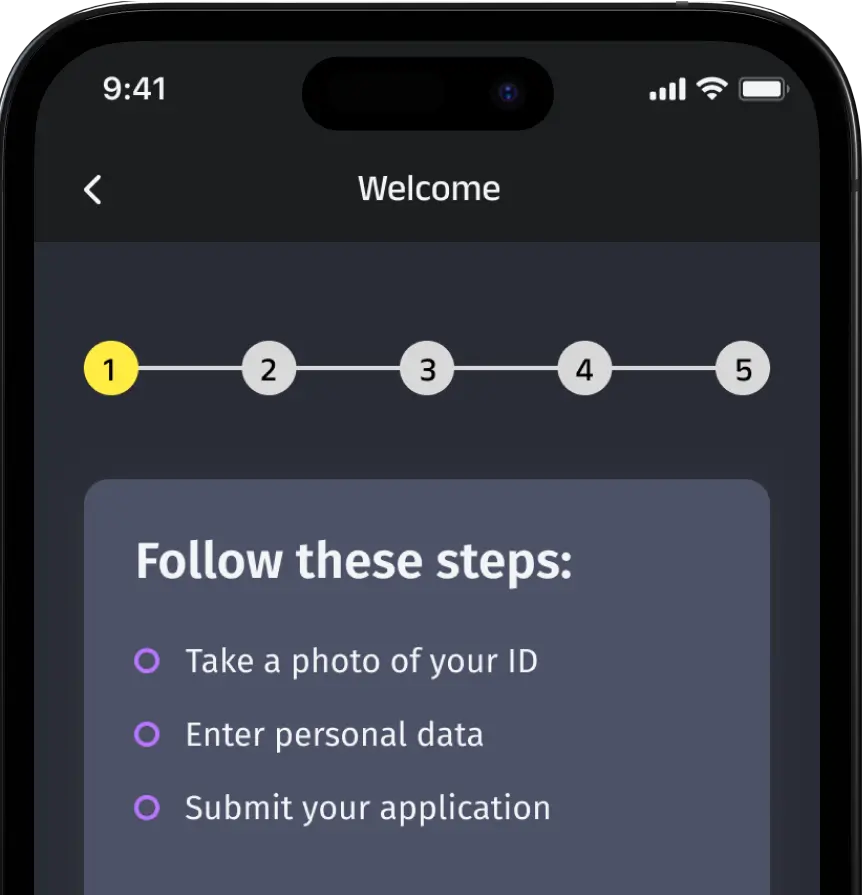

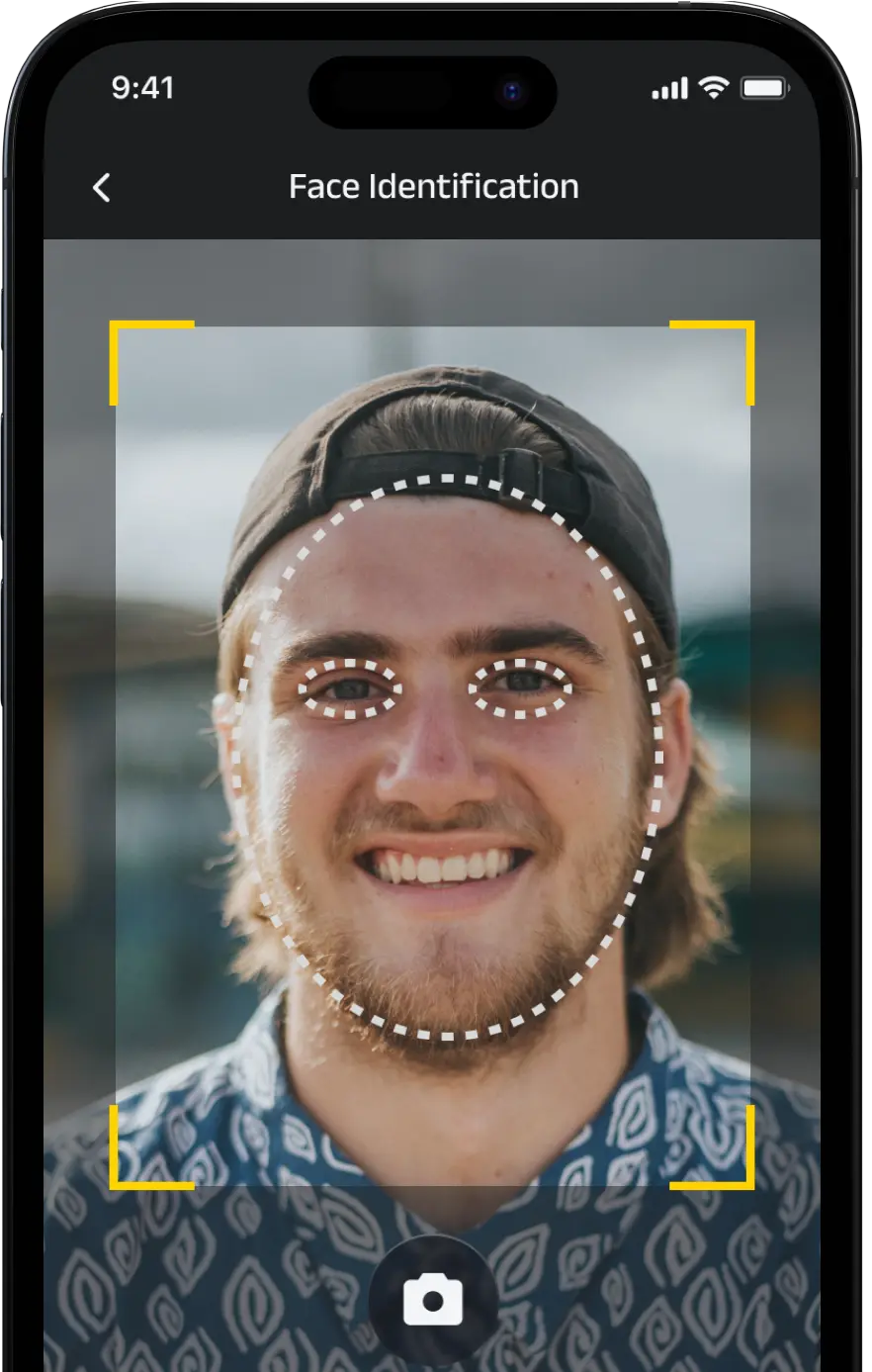

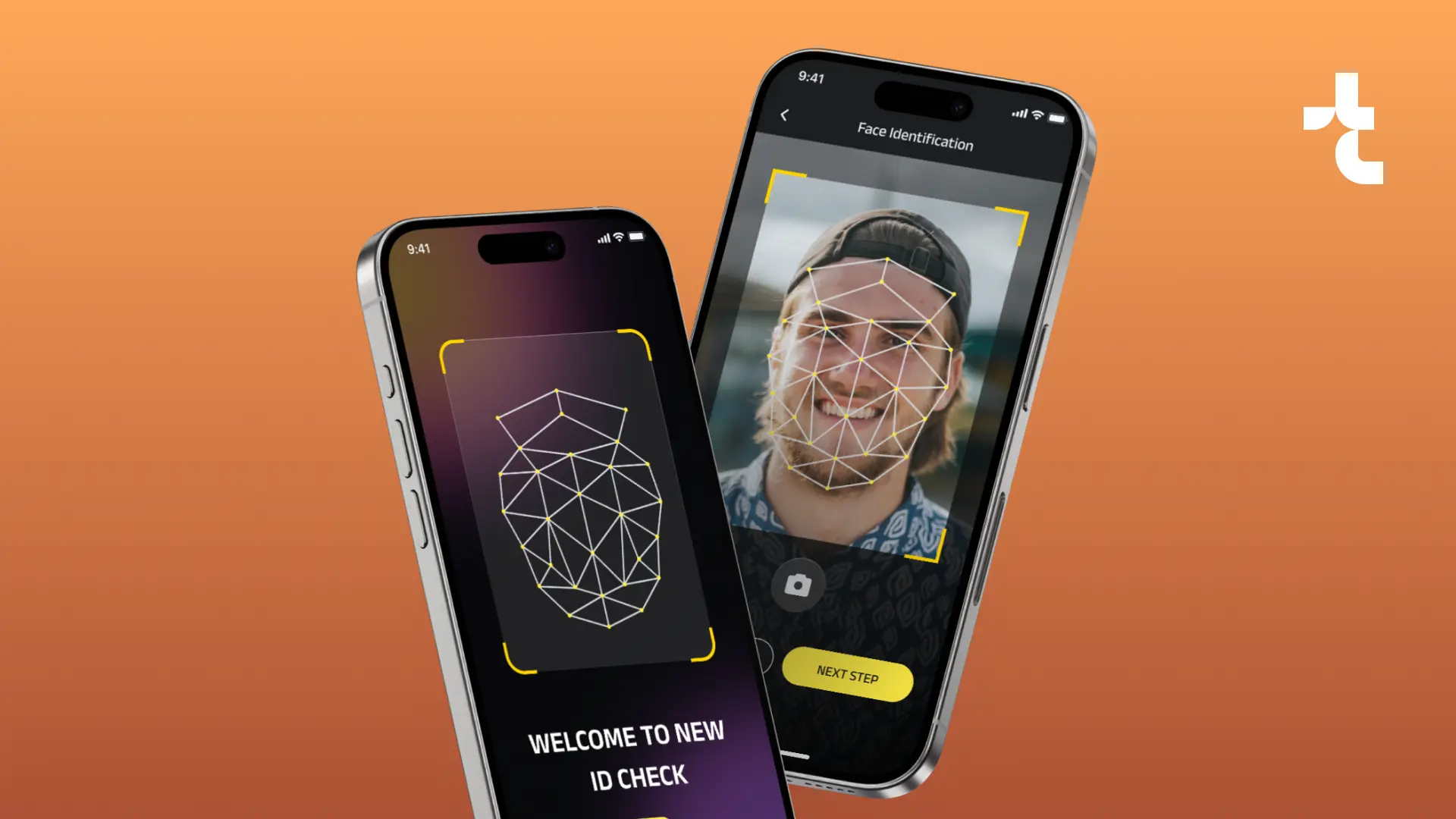

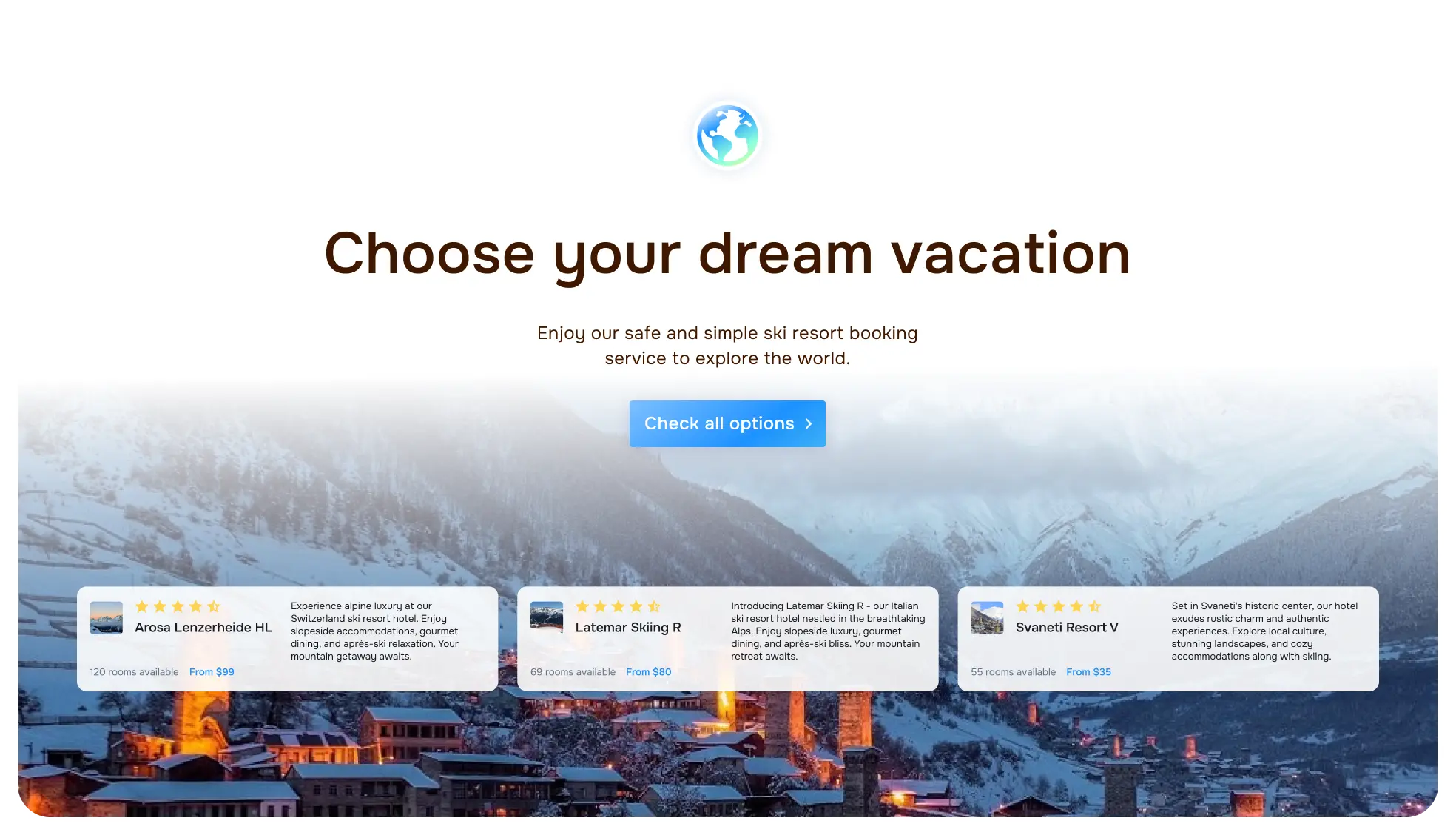

Timspark has crafted a comprehensive mobile and web application to streamline the process of finding and reserving accommodations at ski resorts across the globe. The travel booking software is enhanced with a 24/7 support system and features an intelligent bot that efficiently routes user inquiries for prompt assistance.

#HoReCa

#TravelTech

Client*

Our client operates a global online travel agency dedicated to assisting customers in planning unforgettable holidays at the world’s premier ski resorts.

*We cannot provide any information about the client or specifics of the case study due to non-disclosure agreement (NDA) restrictions.

Project in numbers

The team involved in the project

1 x Project Manager

Challenge

Objectives

Solution & functionality

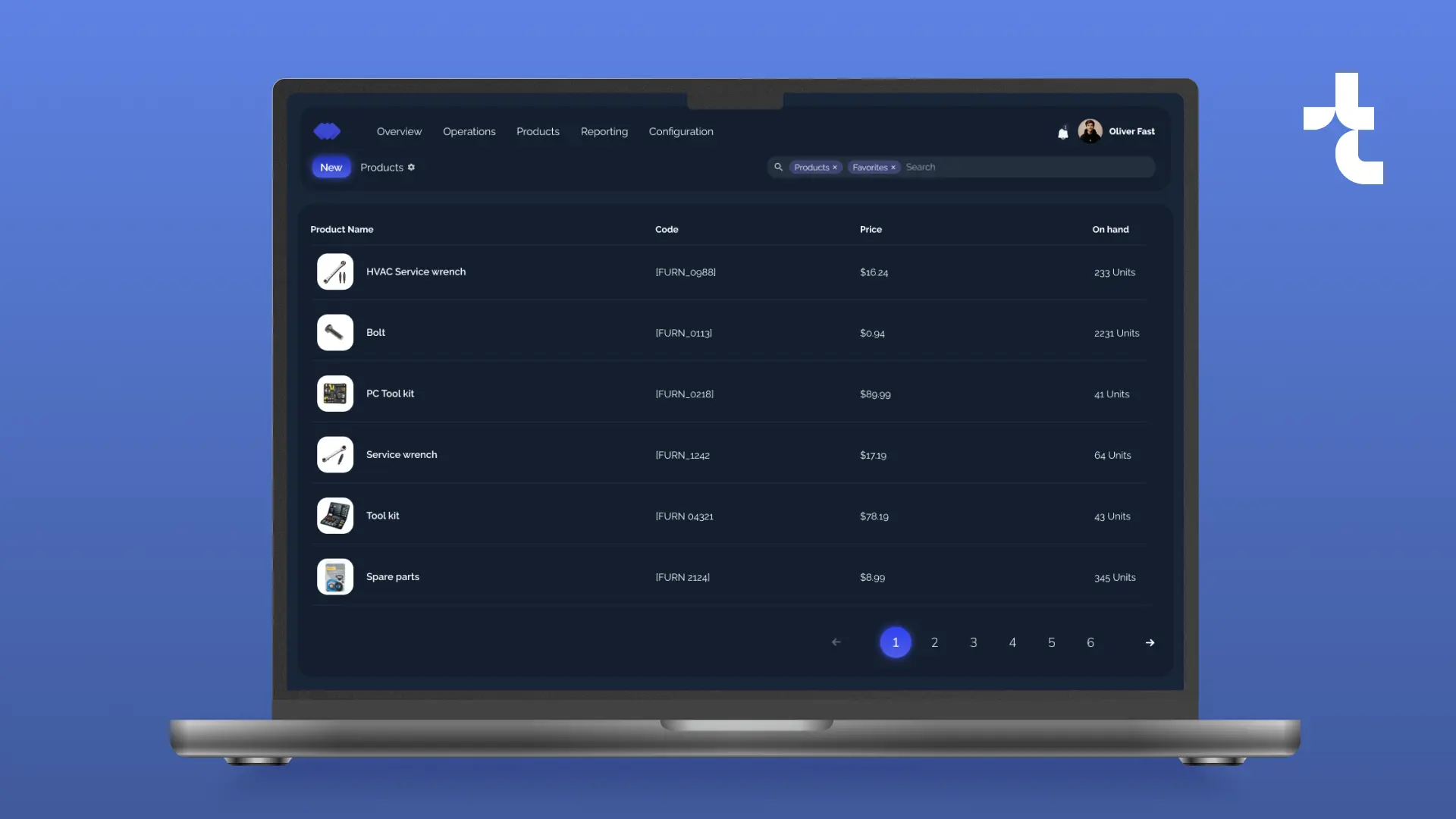

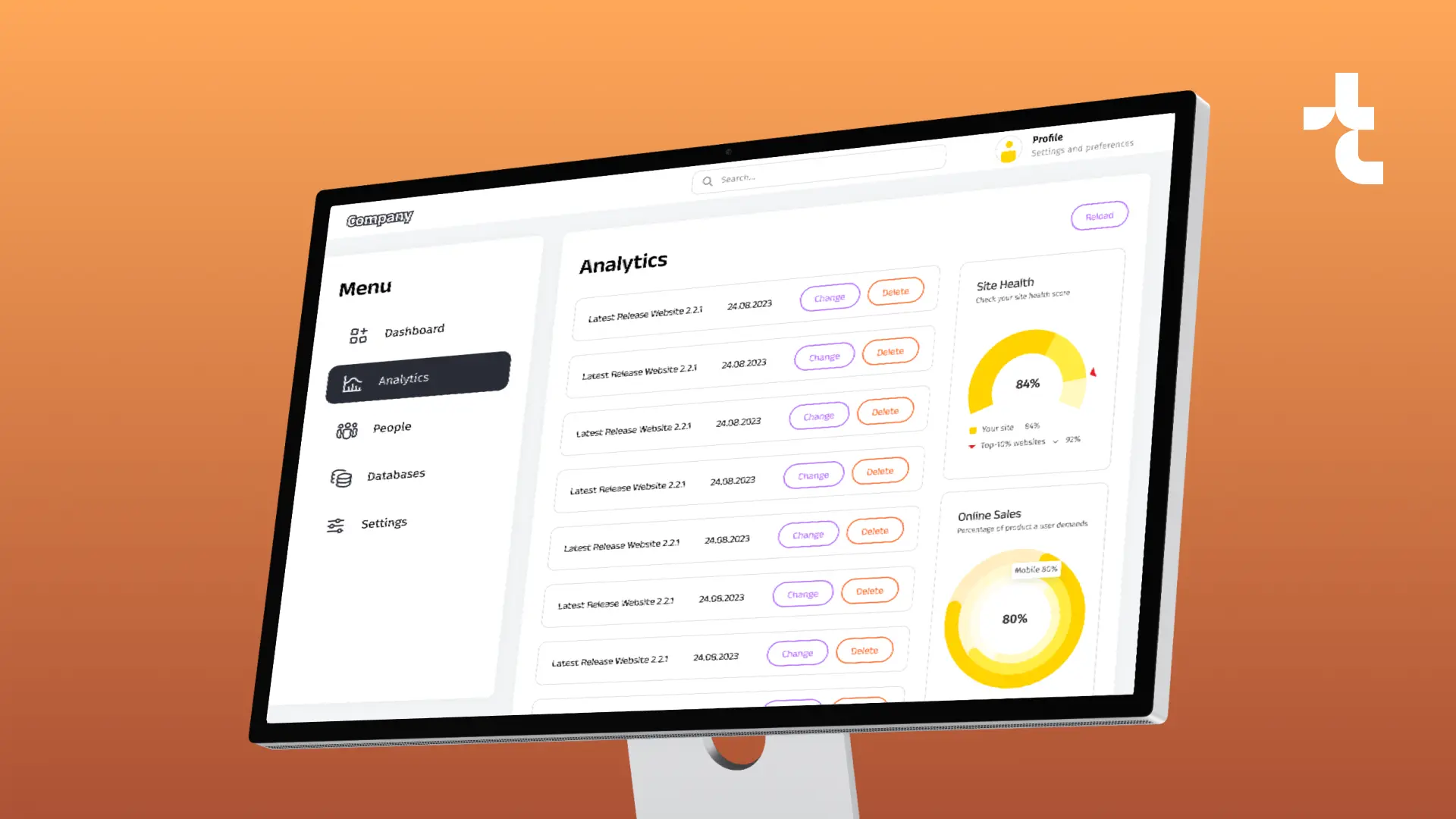

Price adjustment system and supplier management

Our travel management booking software includes critical components like a price adjustment system and supplier management. It allows online travel agencies (OTAs) to access real-time information via APIs and directly links with ski resorts’ property management systems for timely updates.

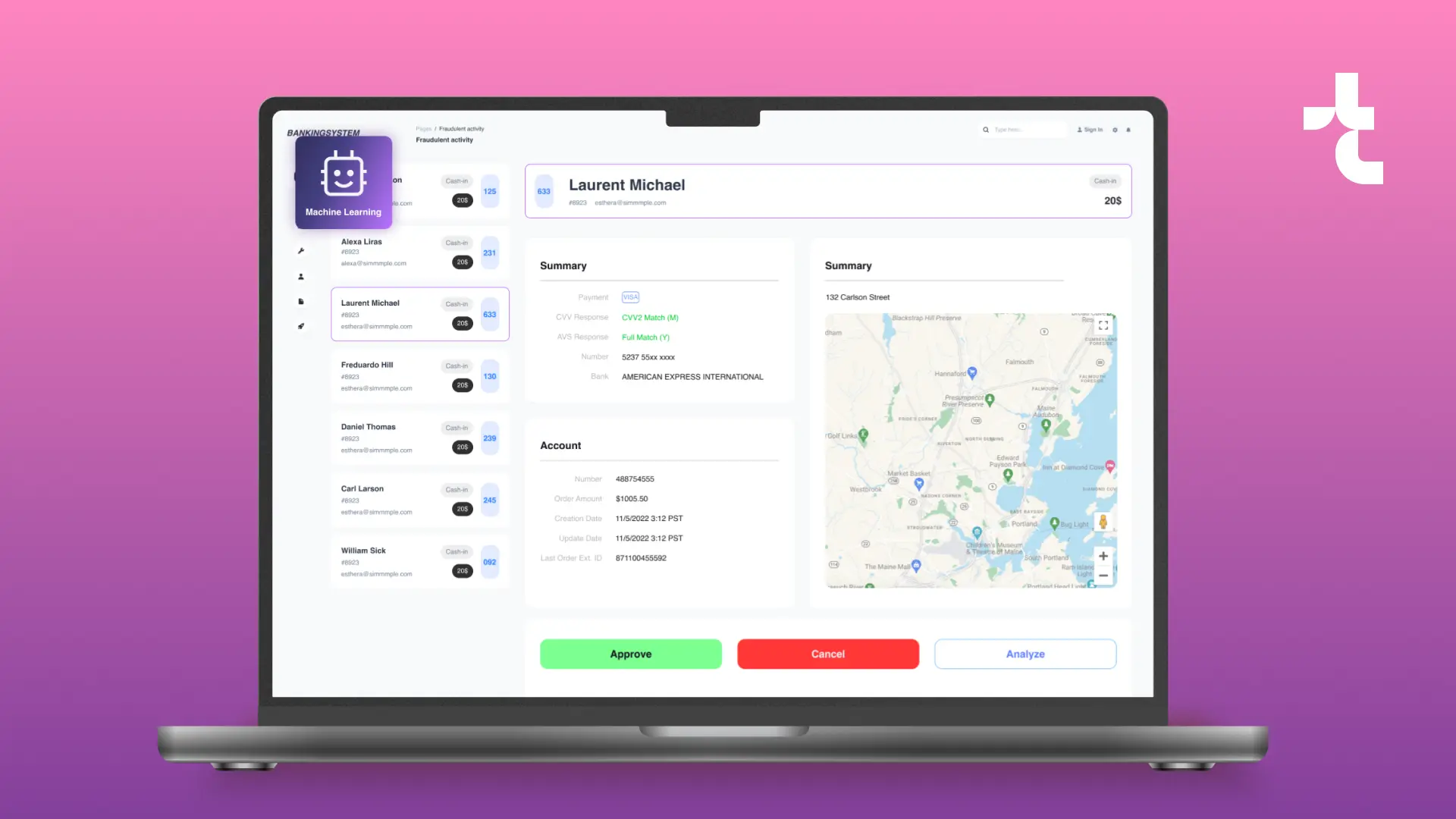

The software also features price tracking and adjustment, dynamically altering commissions based on factors like seasonal trends and competitor pricing. An integrated machine-learning algorithm suggests personalized accommodations based on users’ past preferences.

Smart recommendations and booking flow tracking

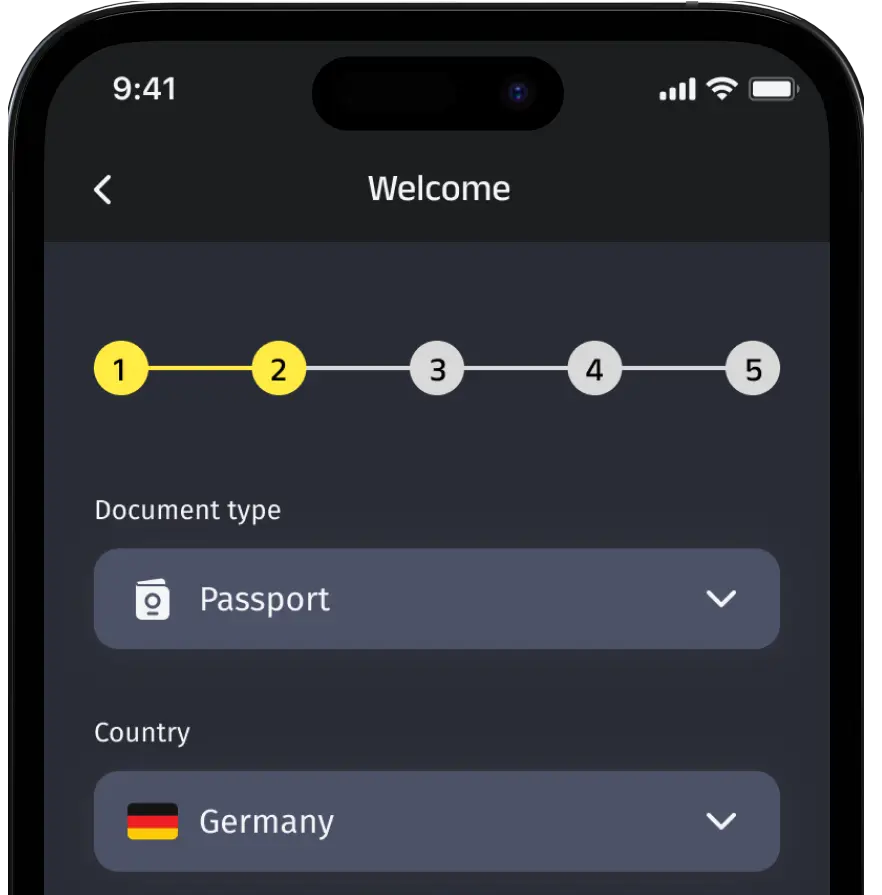

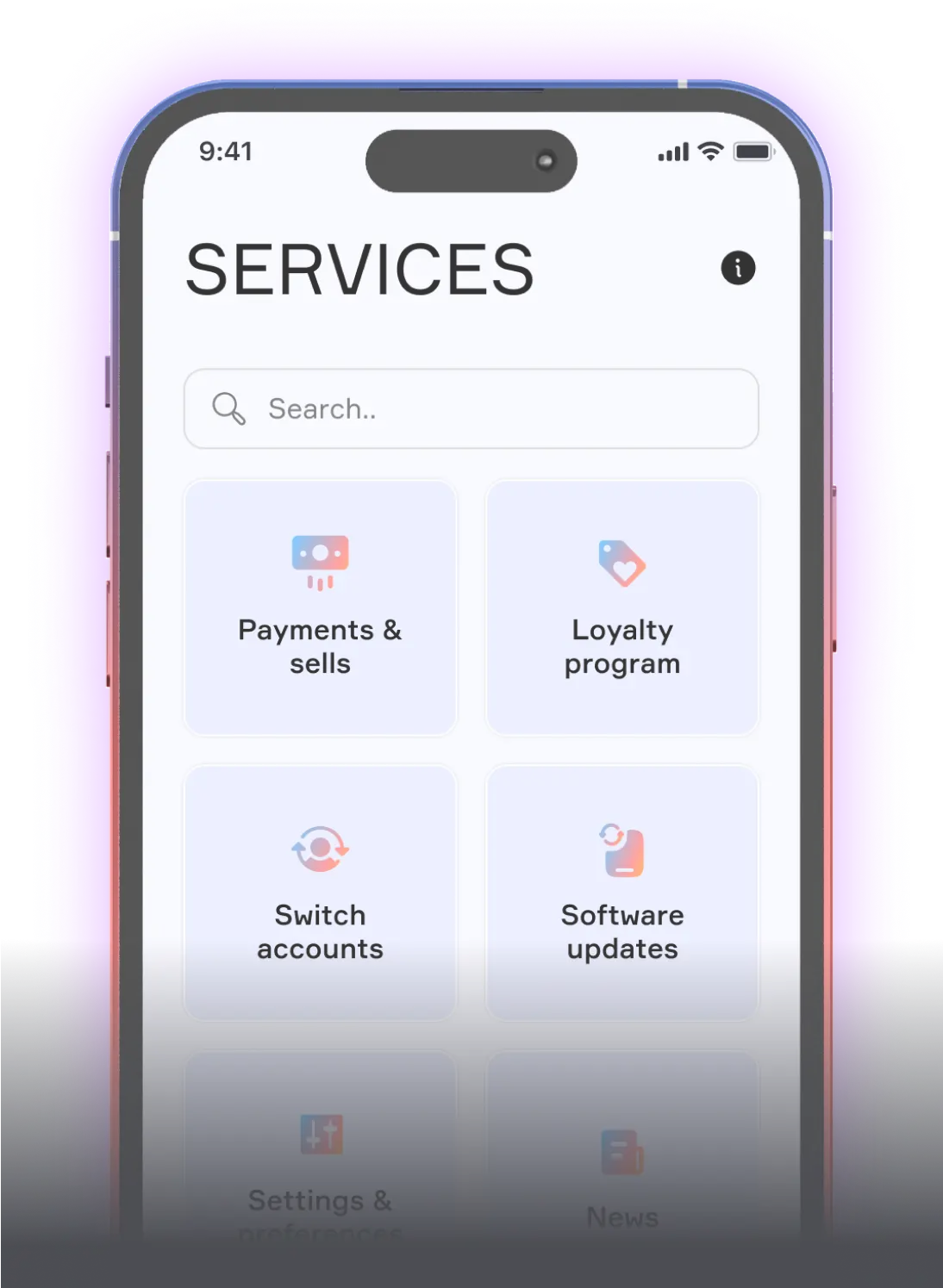

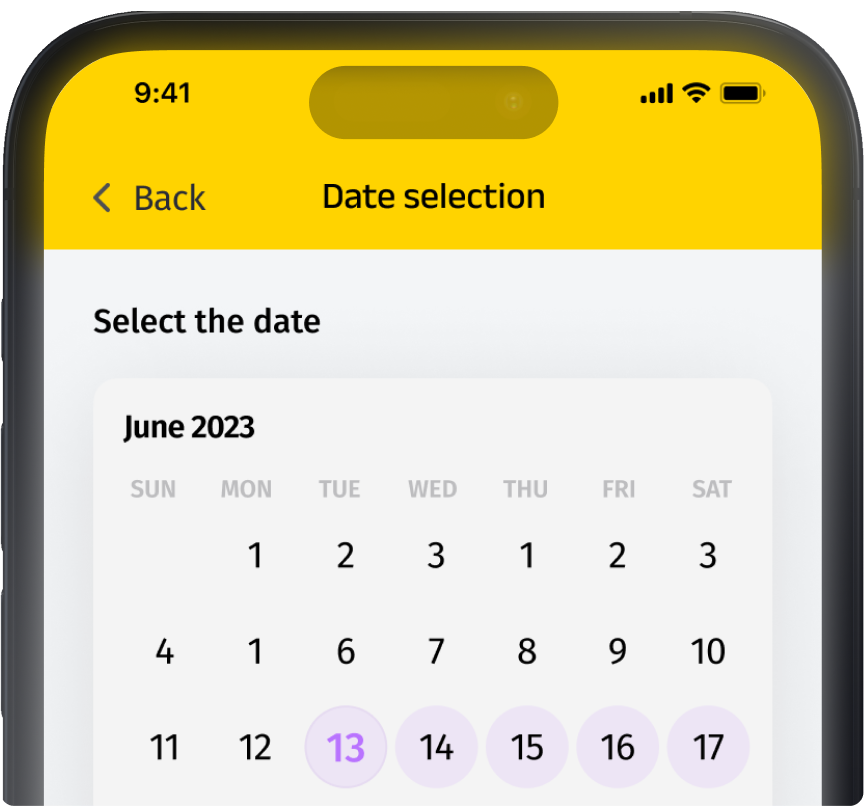

The travel booking software provides tools for defining resort search parameters and allows agency staff to modify them as needed swiftly. Travelers can specify their resort searches based on: Date, Price, Location, Resort size, Ski slope difficulty, Guest ratings, Room availability, Amenities, Catering options, Ski training availability, Popularity score.

This customization lets the agency quickly adjust search criteria and maintain a competitive edge with unique offers and prices that reflect the latest tourism trends.

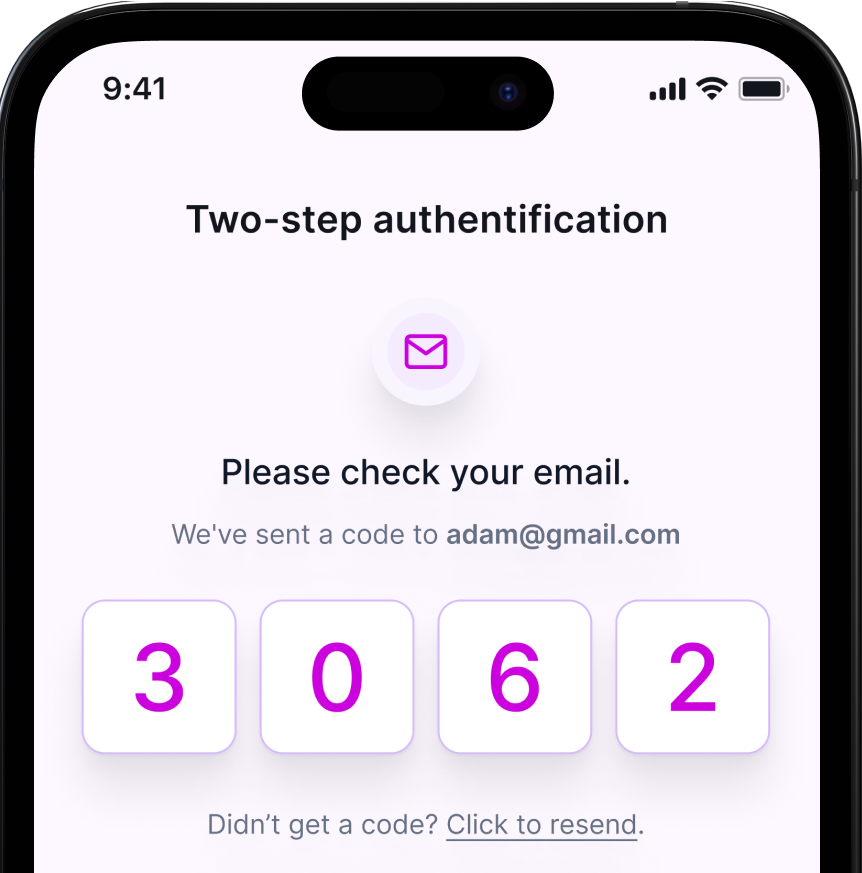

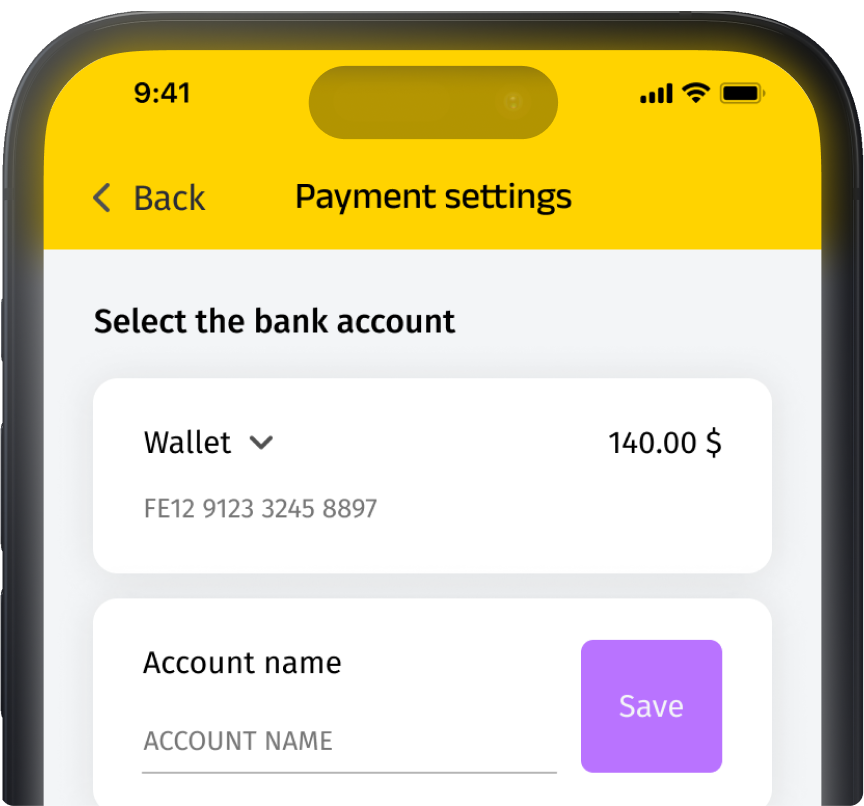

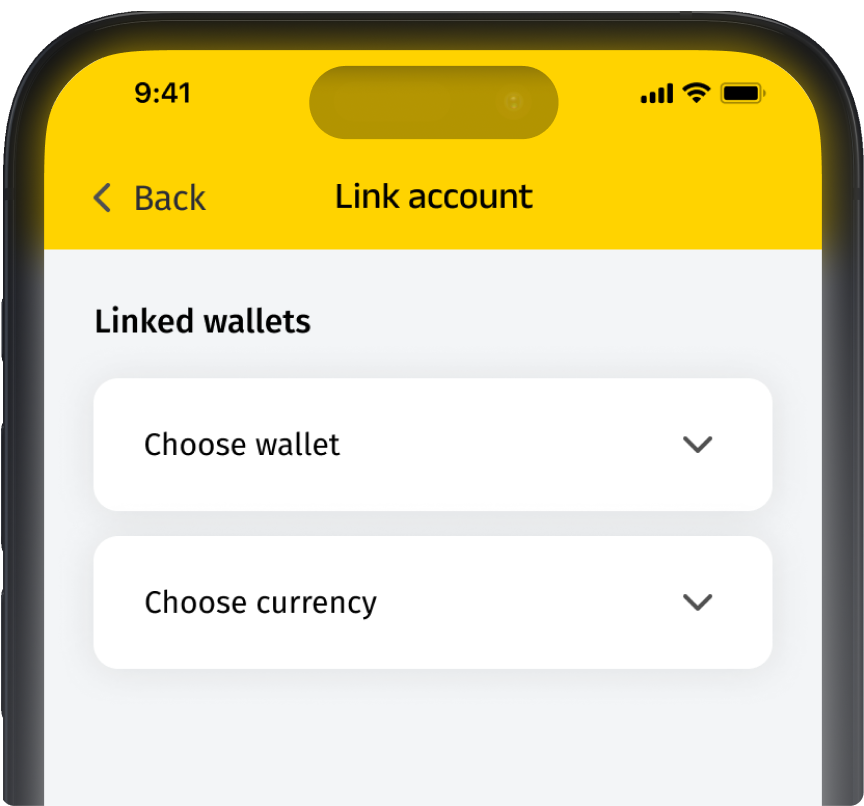

Booking and payment simplification

Our B2C travel management booking software streamlines the comparison of search results from different sources to prevent duplicate listings. The booking tracking system facilitates effortless room reservations at ski resorts, supporting immediate bookings or holds with just a few clicks.

The platform’s API messaging system instantly forwards booking requests to service providers and guides users through the payment process. It supports various payment methods, such as credit cards, PayPal, Apple Pay, Google Pay, and WebMoney. This comprehensive setup ensures a frictionless booking experience for users and enhances satisfaction and loyalty.

Results and business value

83%

14%

Benefits for client

Related cases

Need assistance with a software project?

Whether you're looking for expert developers or a full-service development solution, we're here to help. Get in touch!

What happens next?

An expert contacts you after thoroughly reviewing your requirements.

If necessary, we provide you with a Non-Disclosure Agreement (NDA) and initiate the Discovery phase, ensuring maximum confidentiality and alignment on project objectives.

We provide a project proposal, including estimates, scope analysis, CVs, and more.

Meet our experts!

Viktoryia Markevich

Relationship manager

Samuel Krendel

Head of partnerships