Computer Vision Solution for Effective Advertising Placement

computer vision device

Computer Vision Solution for Effective Advertising Placement

Our team developed an on-premises device based on AI technologies for detecting individuals and showcasing advertisements on DOOH displays in transportation or outdoor locations.

#AI

#WebDevelopment

#Ecommerce

Client*

The client is a world-leading provider of comprehensive visual technology solutions.

Project in numbers

11 months

5 specialists

Team involved in the project

E-commerce

Computer vision and artificial intelligence device for target audience analysis

Python, Pytorch, Cnvrg.io, AWS SageMaker, GCP Vertex AI, Fastdup, Pandas, Numpy, Scipy.

1 x Lead Data Scientist

2 x Data Scientists

2 x Data Engineers

Challenge

The fundamental idea was to create a device harnessing AI technologies for analyzing captured images, discerning the audience’s average attributes, and enabling the presentation of targeted advertising.

Related objectives

Deploy the computer vision model on edge devices with limited GPU and RAM

Train the AI computer vision model with labeled data

Solution & functionality

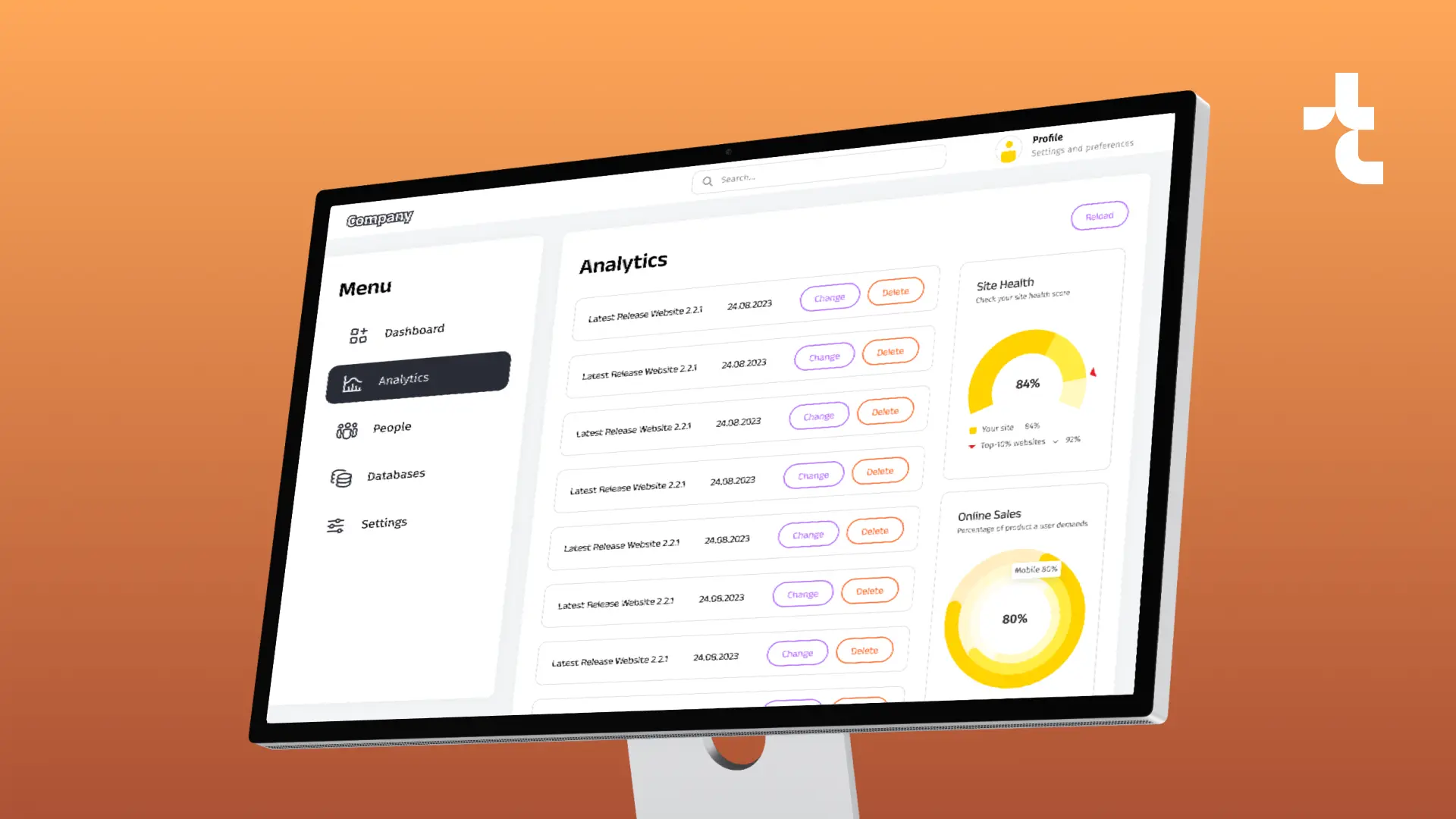

In collaboration with the client’s team, Timspark created a compact on-premises computer vision device that can capture and analyze visual data.

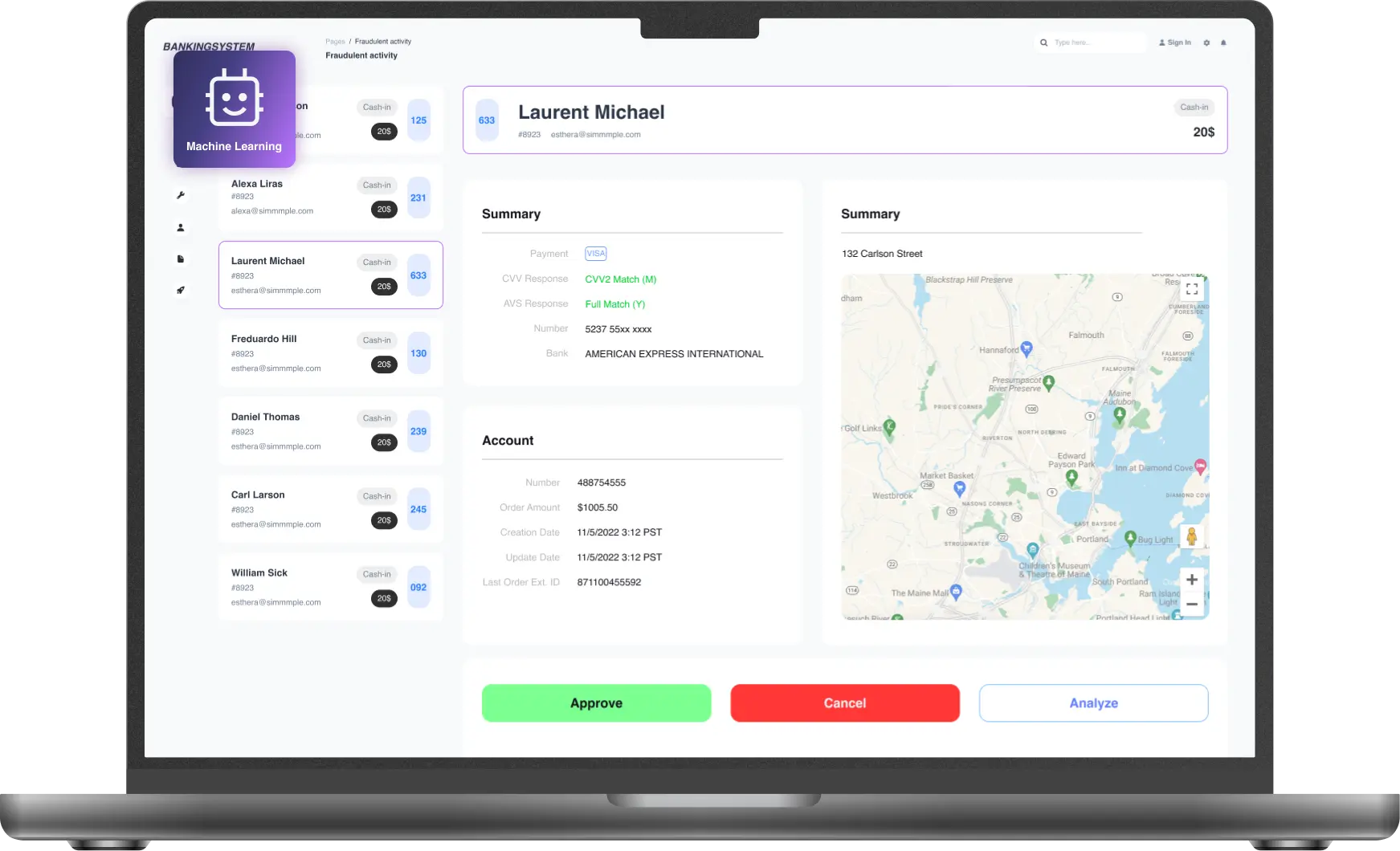

Machine learning model training for successful object recognition

The team developed and fine-tuned the classifier model to meet the project’s unique requirements. The model analyzes received images, determines the average class among all attributes of captured objects, and subsequently identifies the target audience for the advertisement.

Deployment on Jetson Nano and Jetson Xavier

To address challenges linked to the limited memory and slow data processing, the model was transformed into ONNX and TensorRT formats, ensuring its seamless deployment on edge devices such as Jetson Nano and Jetson Xavier.

Results and business value

Our specialists successfully developed a classifying model that detects and tracks individuals within the camera’s field of view. The model analyzes the captured visual data, accurately identifying selected class among all attributes, and displays targeted advertisements on nearby screens in accordance with the specified class request.

Benefits for client

The client successfully applies the computer vision software to show the advertisement effectively to the relevant audience.

Based on the successful results, we are going to improve the model further in our ongoing collaboration.

Related cases

Need assistance with a software project?

Whether you're looking for expert developers or a full-service development solution, we're here to help. Get in touch!

What happens next?

An expert contacts you after thoroughly reviewing your requirements.

If necessary, we provide you with a Non-Disclosure Agreement (NDA) and initiate the Discovery phase, ensuring maximum confidentiality and alignment on project objectives.

We provide a project proposal, including estimates, scope analysis, CVs, and more.

Meet our experts!

Viktoryia Markevich

Relationship manager

Samuel Krendel

Head of partnerships