Machine learning in banking

ML in Banking: 5 Times Less Fraud Risk by Spotting Weird Transactions

Timspark leveraged the power of machine learning in banking to keep an eye on digital transactions and catch any abnormal behavior with a new extension for the existing client’s system.

#Fintech #Banking

#MachineLearning

#DataAnalytics

Client*

We have partnered with a major bank that has branches all over the US, providing loans, deposits, and more banking products.

*We cannot provide any information about the client or specifics of the case study due to non-disclosure agreement (NDA) restrictions.

Project in numbers

duration

19 months

team

13 specialists

Team involved in the project

industry

Banking, Fintech

solution

ML-based system for fraud risk analysis and detection

technologies

Python, Scala, DVC, MLFlow, Comet, Apache Spark MLLib, Scikit-learn, LightGBM, XGBoost, Hyperopt, PySpark, Numpy, Pandas, Scipy, Docker, Docker Compose, Kubernetes, Jenkins

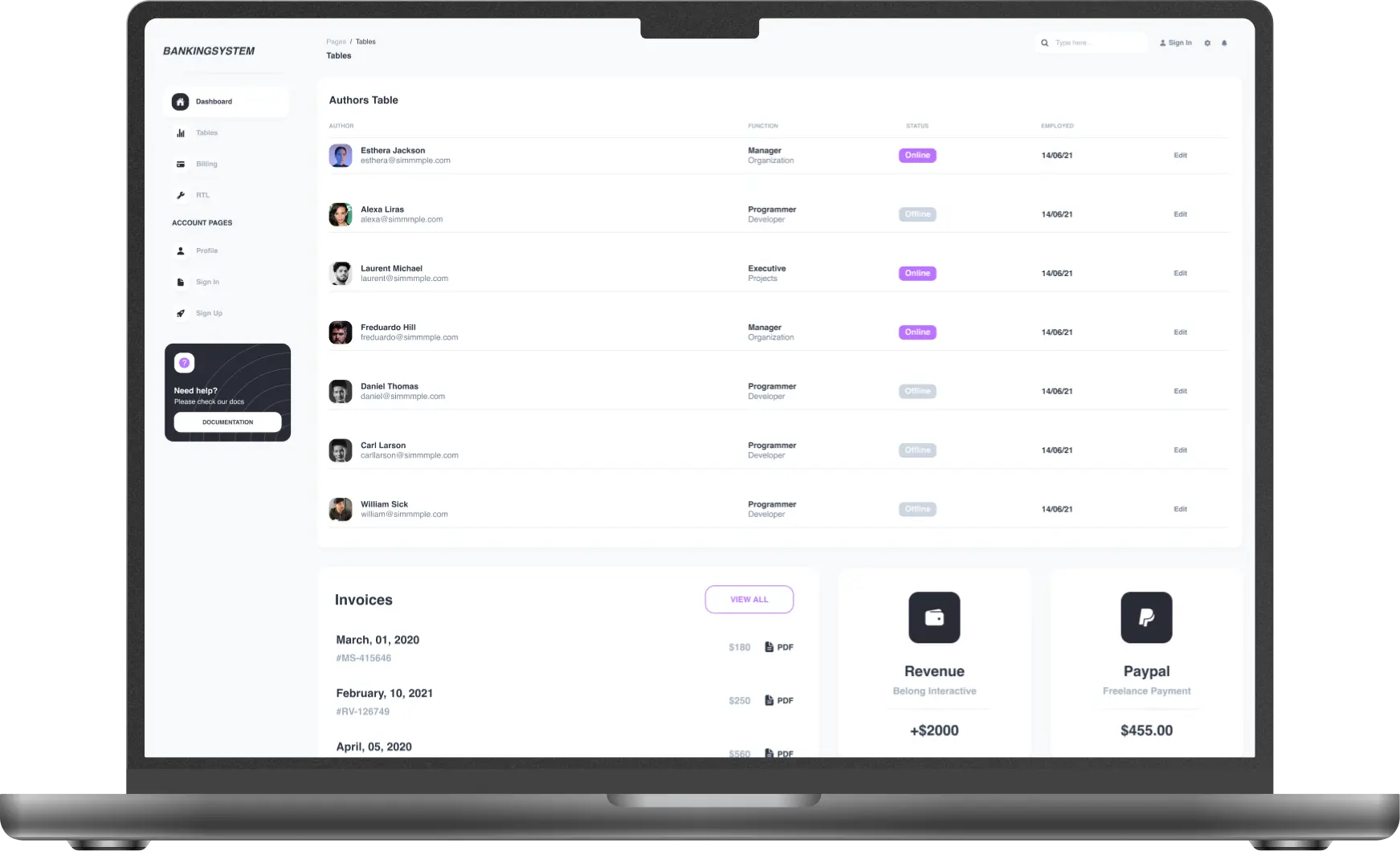

2 x Frontend Developers

2 x Backend Developers

1 x Project Manager

1 x Business Analyst

2 x Data Engineers

3 x ML Engineers

1 x QA Engineer

1 x UX/UI Designer

Challenge

The key American bank faced rising financial fraud threats, and traditional systems proved ineffective. We were picking the best ways to use machine learning in banking and finance against increasing fraudulent activities that endangered customer safety and the bank’s reputation.

Related objectives

Implement ML for fraud detection

Upgrade the anti-money laundering system

Increase customer safety

Improve the bank’s reputation

Solution & functionality

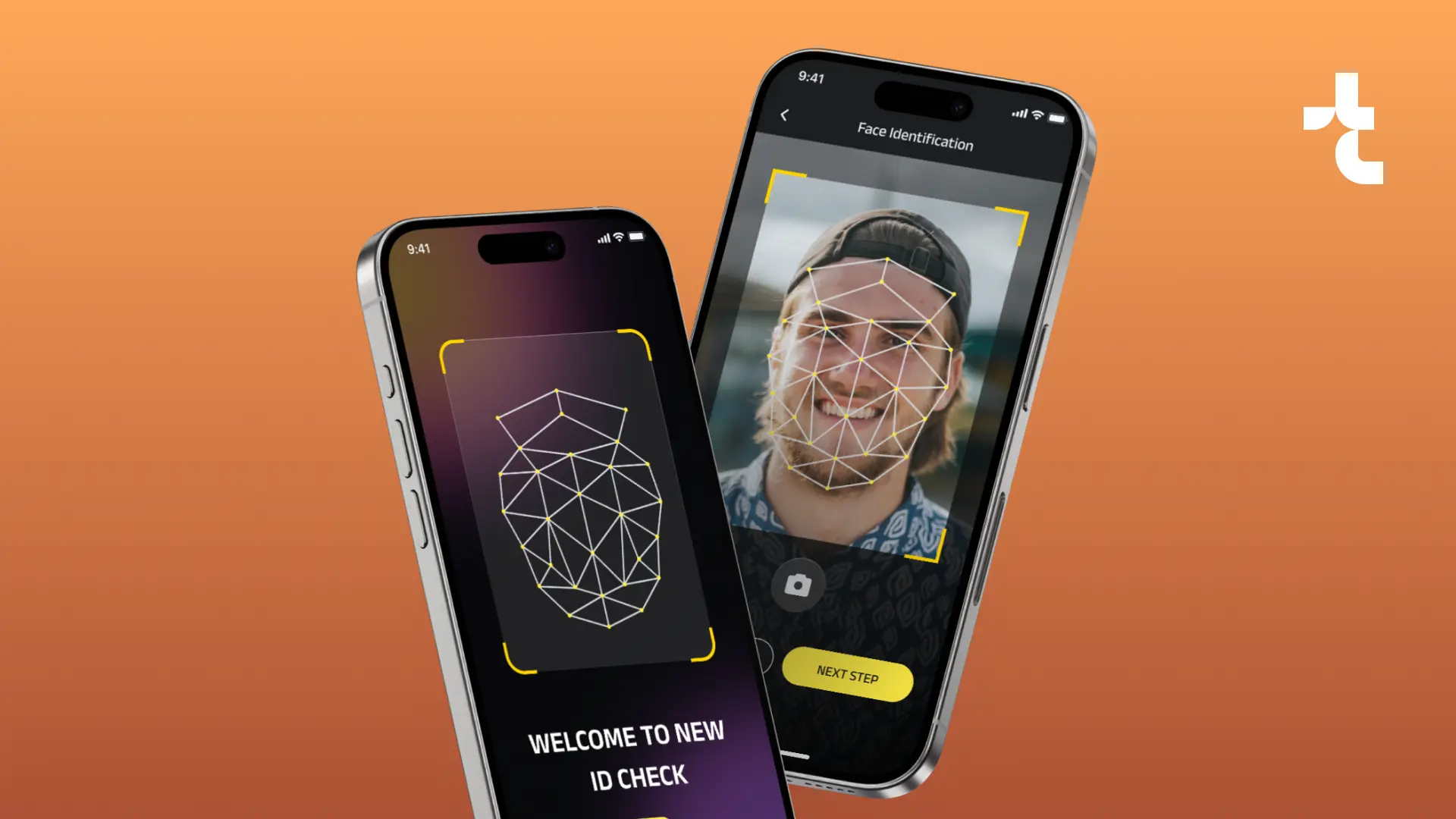

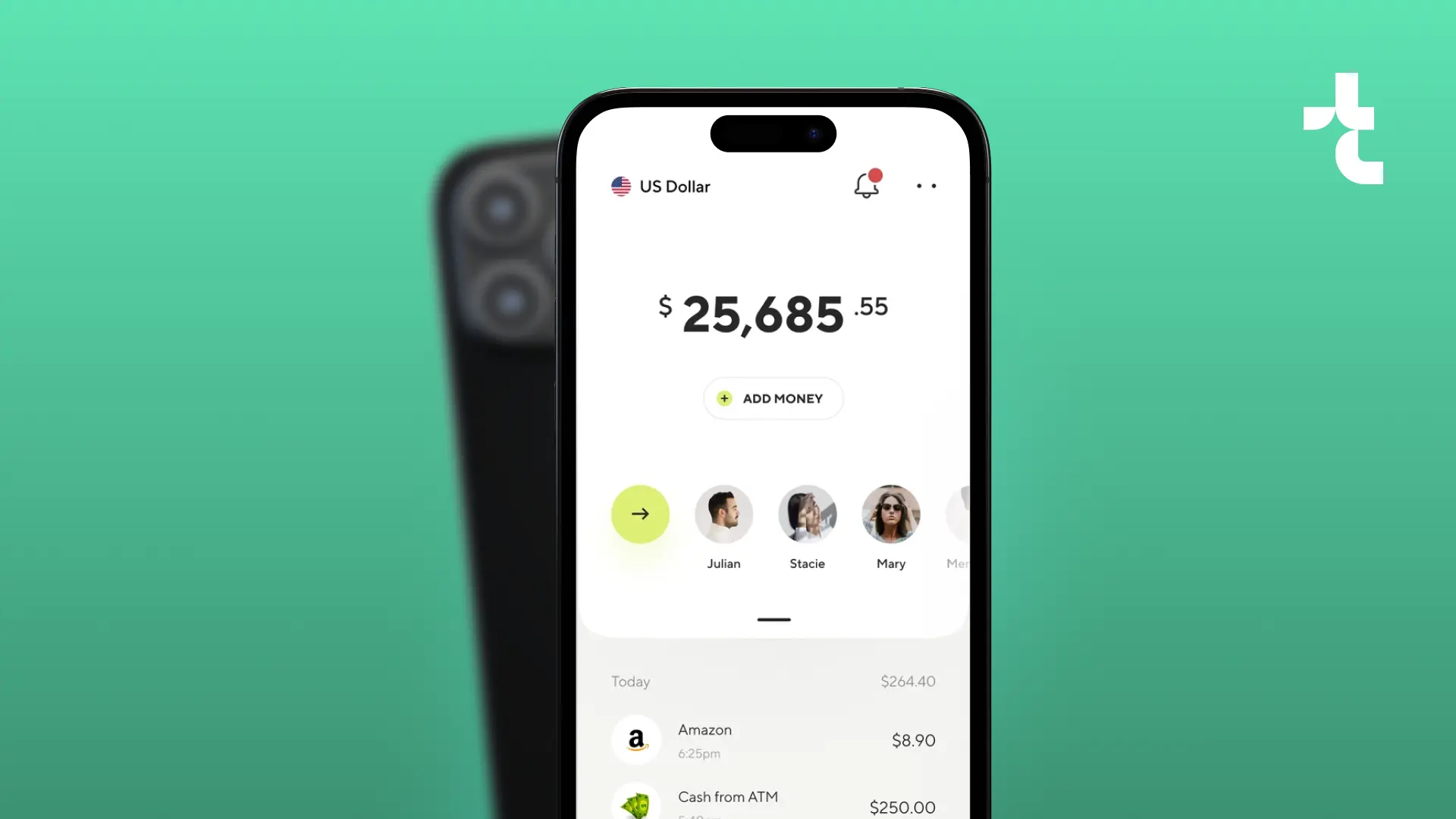

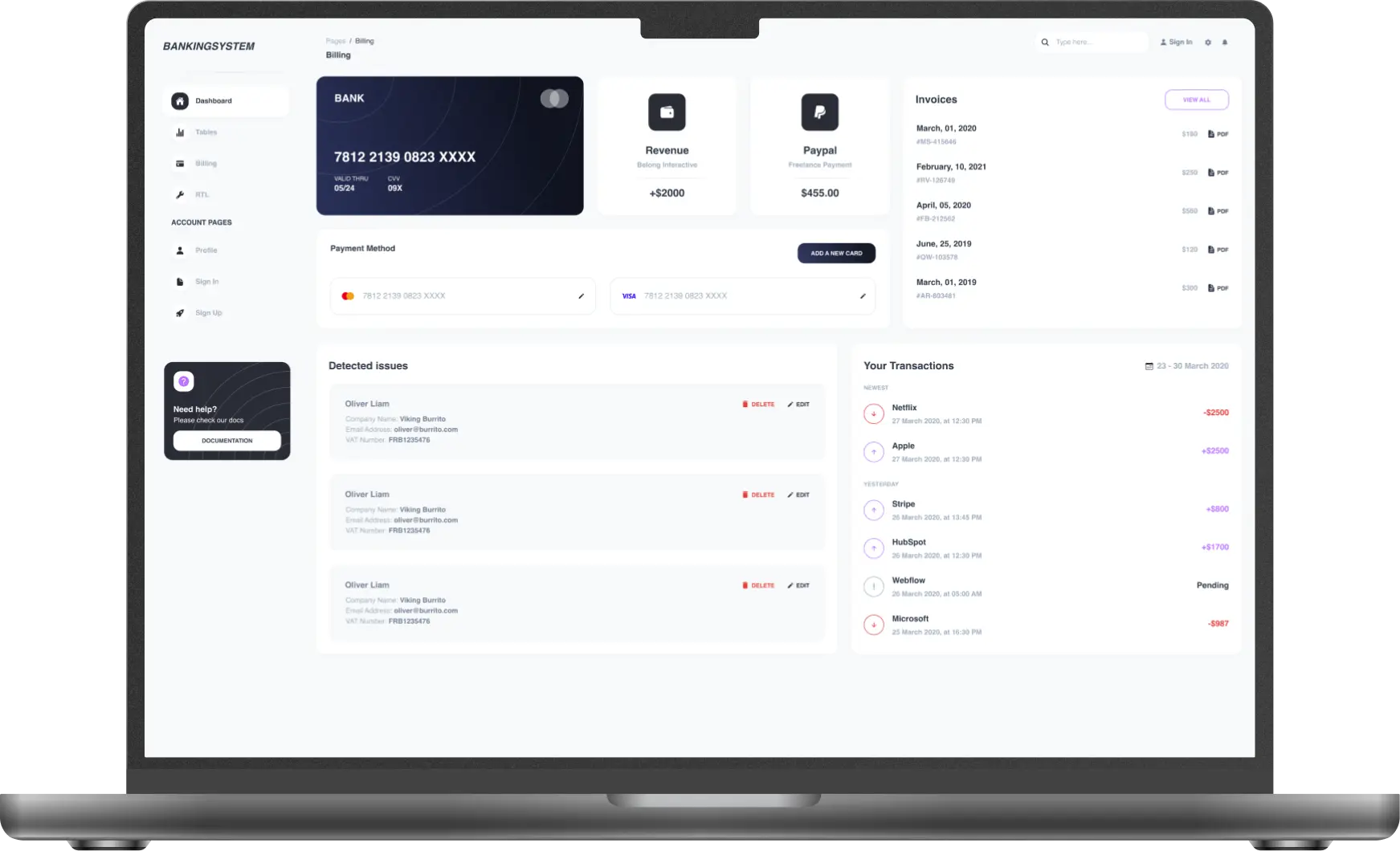

We suggested adding an ML-powered extension to the banking system to scrutinize large data volumes and protect funds from malicious activities. It analyzes account holders’ transactions and raises alerts for any unusual, suspicious, or fraudulent behavior. With deep learning fintech algorithms, our team processed extensive data to spot irregularities signaling potential fraud risk.

Aggregating data

To begin, our engineers collected and unified all banking data, encompassing user identities, transaction histories, locations, payment methods, and other pertinent factors.

Detecting anomalies

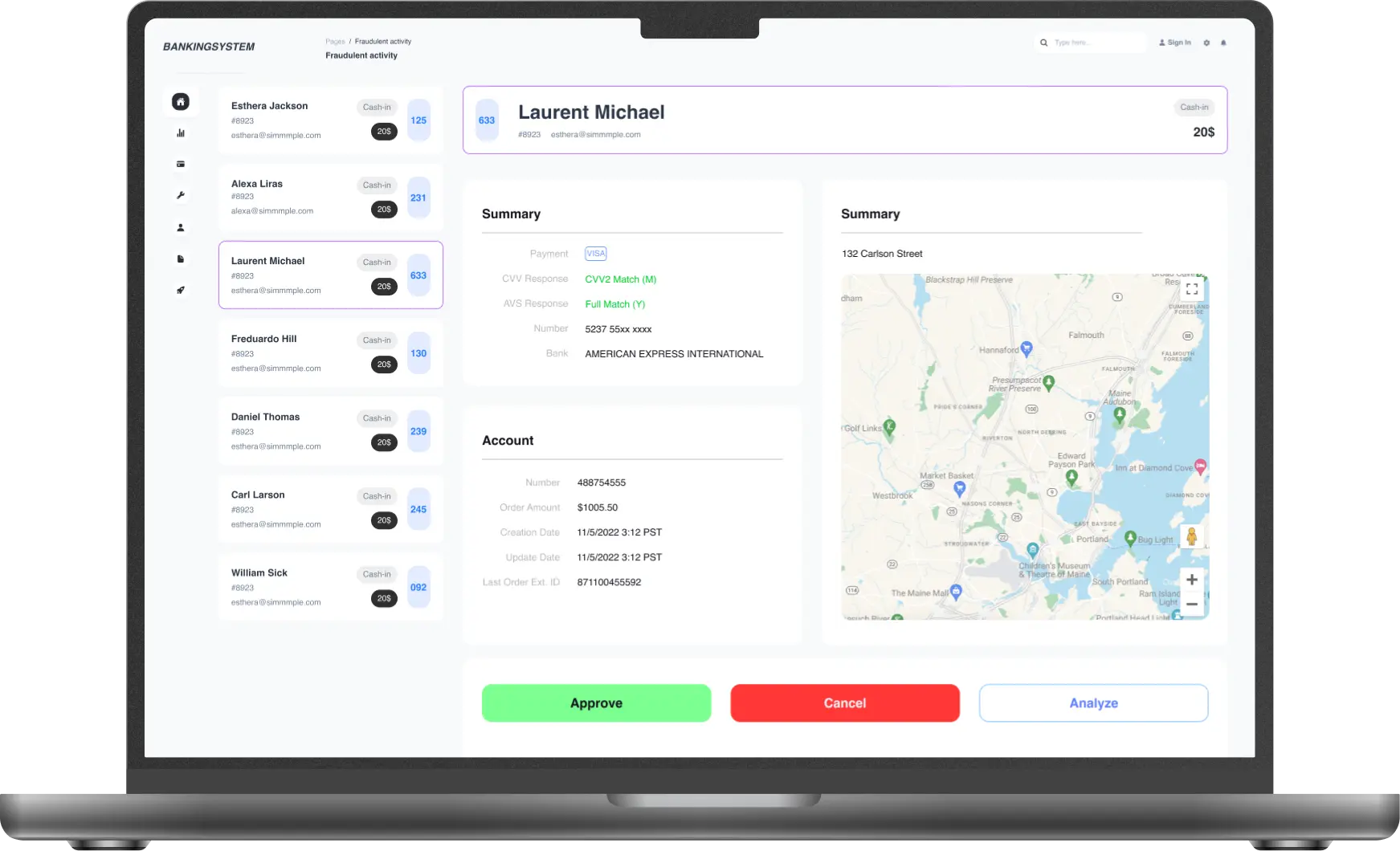

We identified distinctive patterns like high transaction amounts or segmented transactions to avoid automated tax reporting, enabling ML algorithms to distinguish fraud from regular banking. Transactions are tagged as “good” or “bad”.

We also accessed a vast dataset, efficiently spotting patterns and anomalies, and selected crucial features through data comparison and elimination techniques, improving fraud risk analysis and detection.

Training the ML model

Our ML team created algorithms to catch odd situations that slip past regular rules. This extension can predict even with less data, using smart machine-learning methods. So, our solution uses embedded representations, not typical features, to handle transactions.

Implementing the ML model

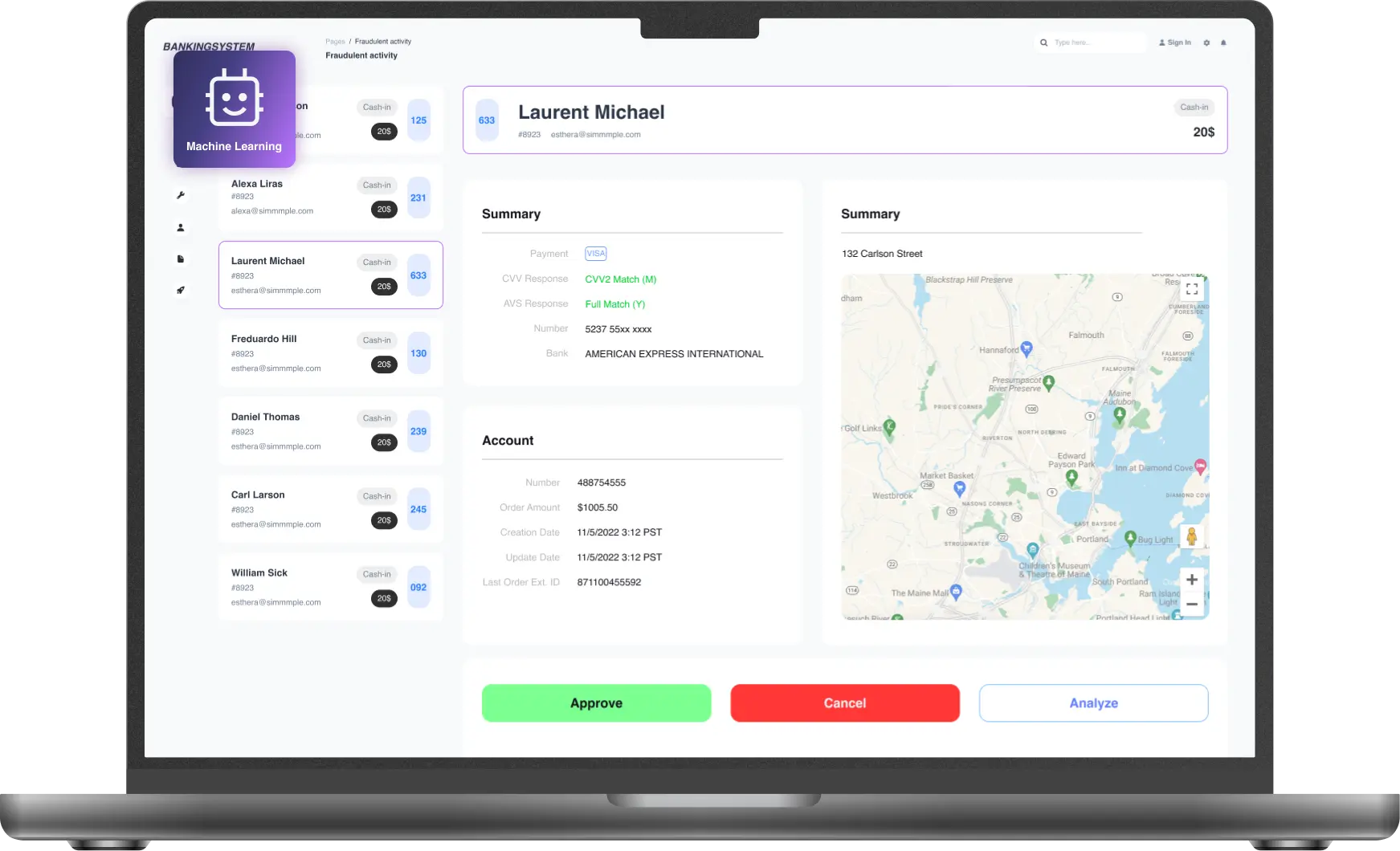

Once a threat’s spotted, the system shoots real-time data to the admin, who can stop or nix operations for further digging. Depending on the fraud chance, there are three outcomes:

- If fraud odds are below 5%, the transaction gets the green light.

- If the odds range between 6% and 70%, an extra check like an SMS code, fingerprint, or secret question is needed.

- If the fraud chance tops 80%, the transaction’s axed, needing hands-on analysis.

Plus, we set up good ML tools to explain models, making predictions clear and keeping things smooth for users.

Results and business value

Timspark’s top-notch ML extension spots fraud and takes action. Security’s solid — no breaches or financial crimes.

x2.4 speedier in processing

Our ML algorithms swiftly handle heaps of data, keeping up with the rapid transactions.

99.3% accuracy of fraud detection

Using these algorithms, we find tricky patterns that humans might miss. That means fewer mistakes and less unseen fraud.

Less mundane tasks

Our solution checks hundreds of thousands of payments per second, making the transaction process as painless as possible.

The algorithms catch tiny changes fast, checking tons of payments per second. The bank gets tighter security, faster transactions, and less chance of missed fraud. It means smoother banking and peace of mind for the end customers.

Related cases

Get in touch with us

Book a call or fill out the form below and we’ll get back to you once we’ve processed your request.

What happens next?

An expert contacts you after thoroughly reviewing your requirements.

If necessary, we provide you with a Non-Disclosure Agreement (NDA) and initiate the Discovery phase, ensuring maximum confidentiality and alignment on project objectives.

We provide a project proposal, including estimates, scope analysis, CVs, and more.

We're here to help!

Relationship Manager

Marketing Lead