ML in Banking: 5 Times Less Fraud Risk by Spotting Weird Transactions

Client*

Project in numbers

Team involved in the project

Python, Scala, DVC, MLFlow, Comet, Apache Spark MLLib, Scikit-learn, LightGBM, XGBoost, Hyperopt, PySpark, Numpy, Pandas, Scipy, Docker, Docker Compose, Kubernetes, Jenkins

Challenge

Related objectives

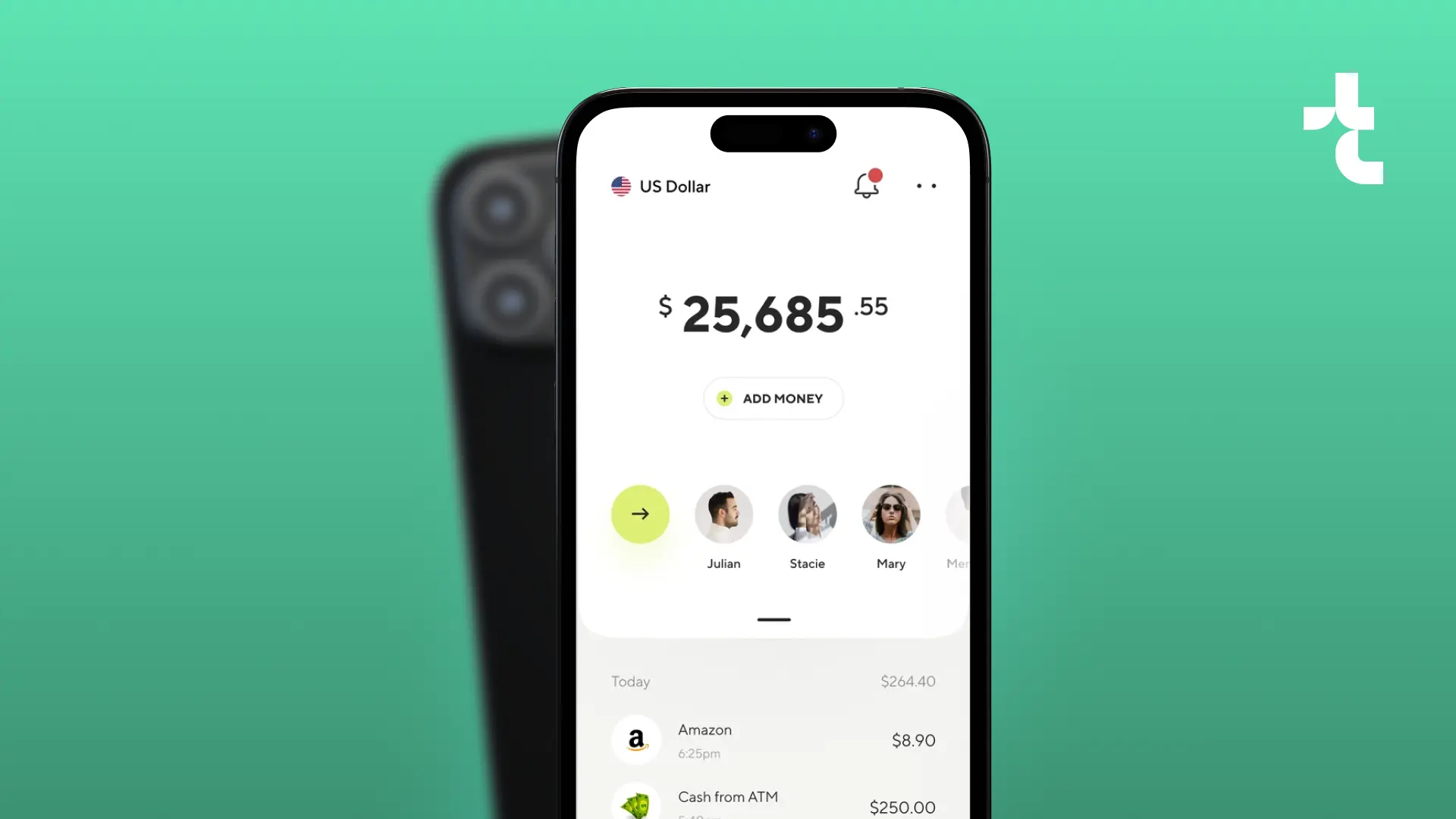

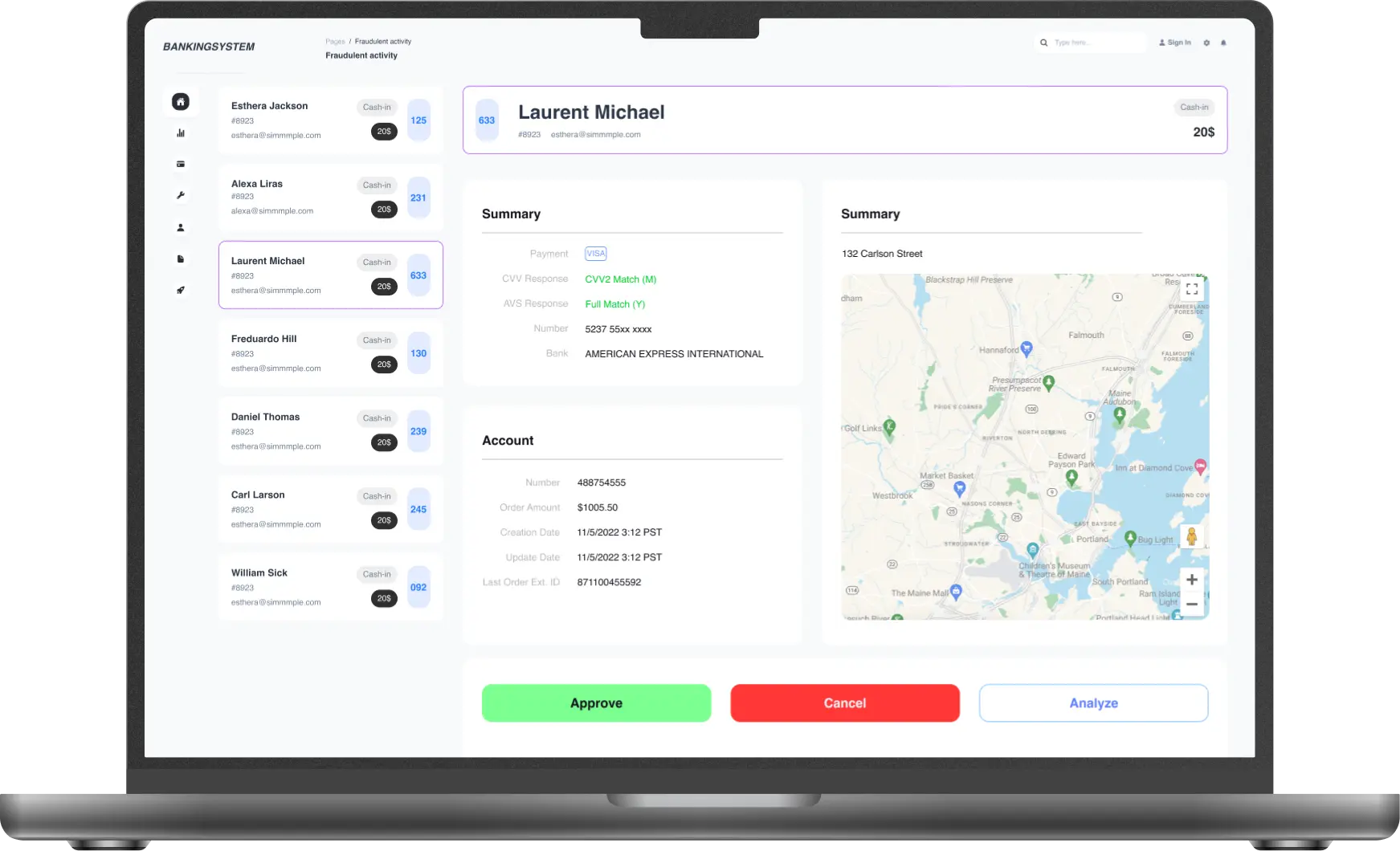

Solution & functionality

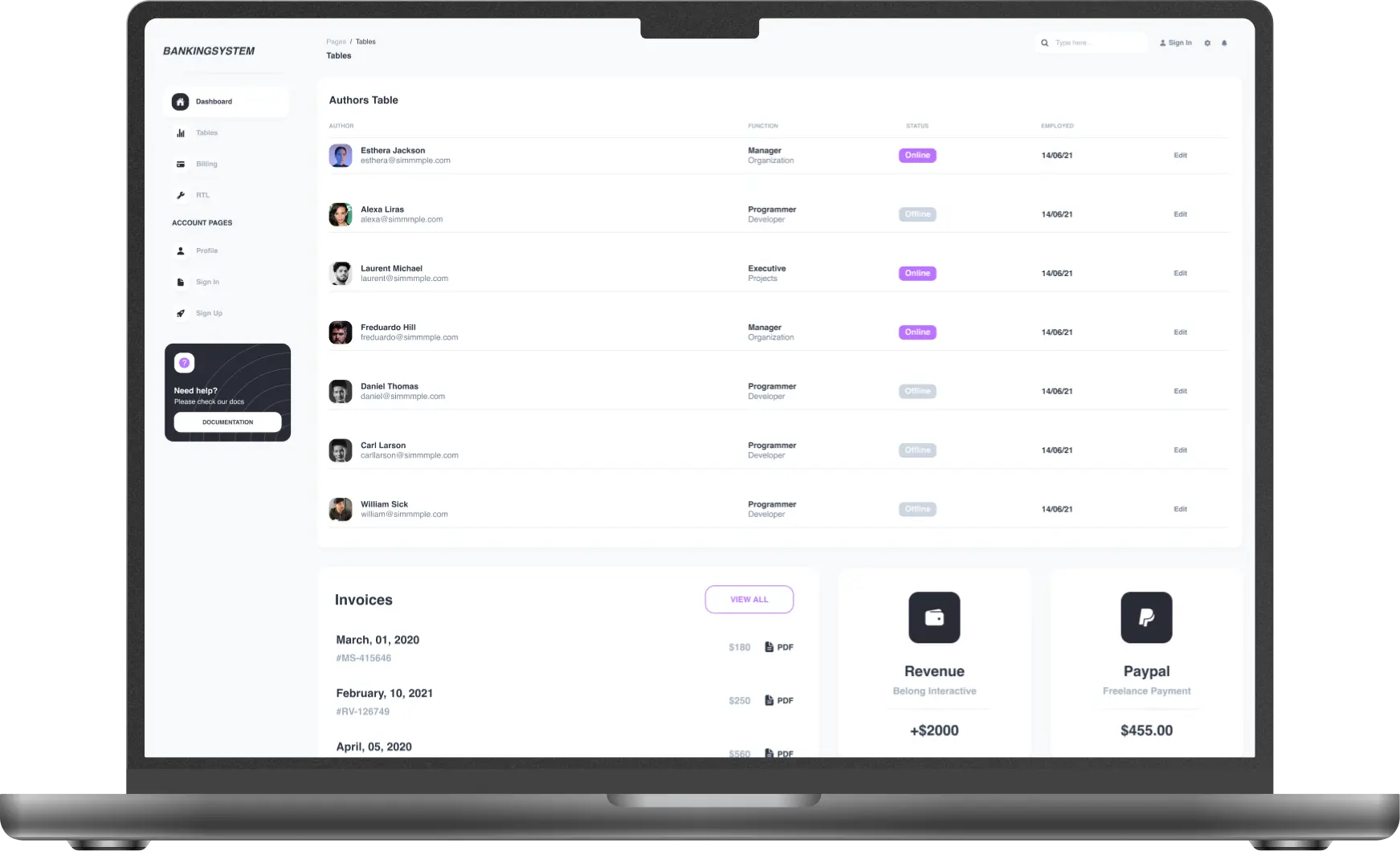

Aggregating data

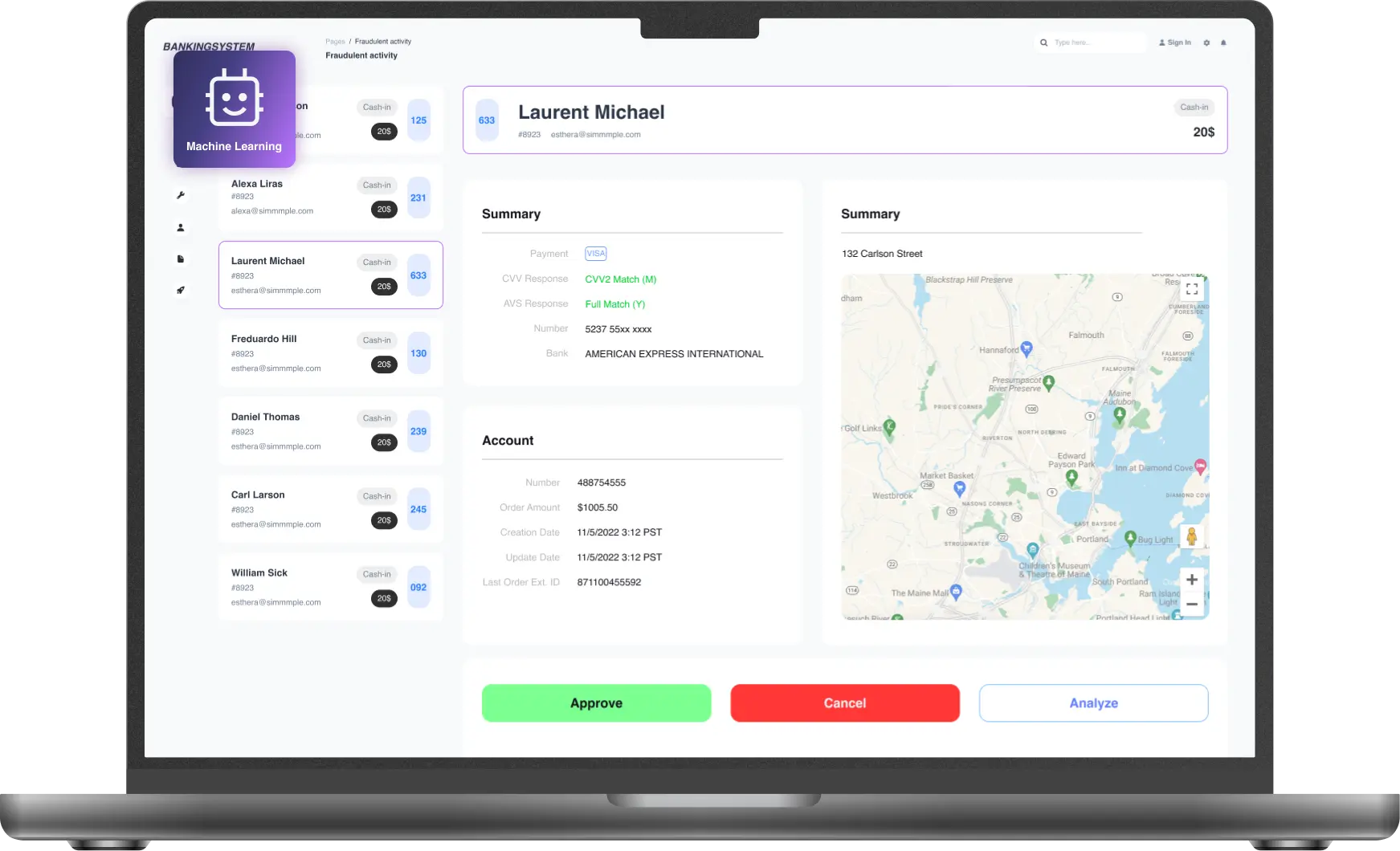

Detecting anomalies

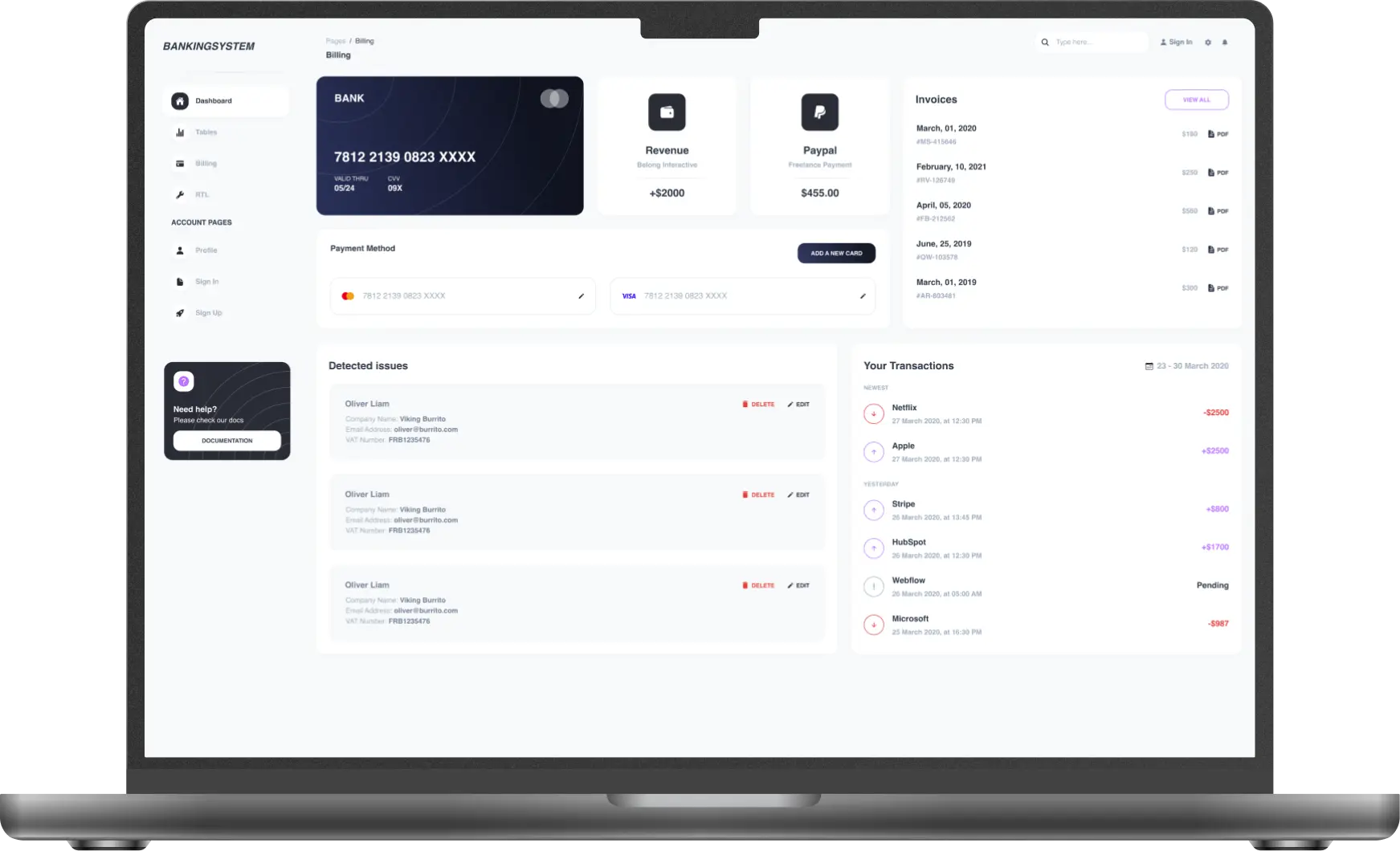

Training the ML model

Implementing the ML model

- If fraud odds are below 5%, the transaction gets the green light.

- If the odds range between 6% and 70%, an extra check like an SMS code, fingerprint, or secret question is needed.

- If the fraud chance tops 80%, the transaction’s axed, needing hands-on analysis.

Results and business value

x2.4 speedier in processing

99.3% accuracy of fraud detection

Less mundane tasks

Need assistance with a software project?

Whether you're looking for expert developers or a full-service development solution, we're here to help. Get in touch!

What happens next?

An expert contacts you after thoroughly reviewing your requirements.

If necessary, we provide you with a Non-Disclosure Agreement (NDA) and initiate the Discovery phase, ensuring maximum confidentiality and alignment on project objectives.

We provide a project proposal, including estimates, scope analysis, CVs, and more.

Meet our experts!

Viktoryia Markevich

Relationship manager

Samuel Krendel

Head of partnerships