Identification mobile app

Optimizing KYC Framework for iOS and Android

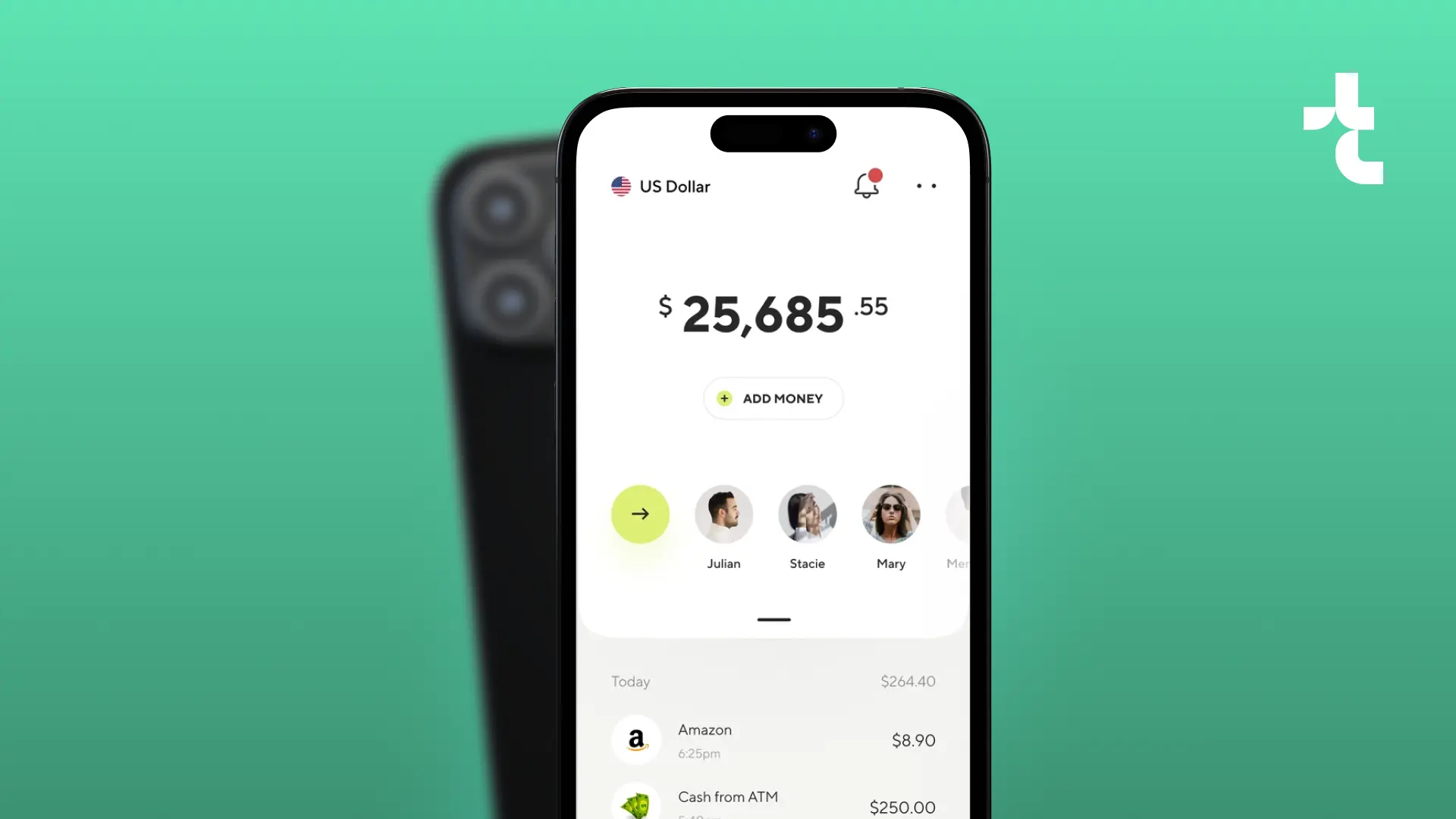

Our team upgraded identity mobile apps for iOS and Android and optimized their key verification and access management functions.

#Banking

#MobileDevelopment

#DataProtection

Client*

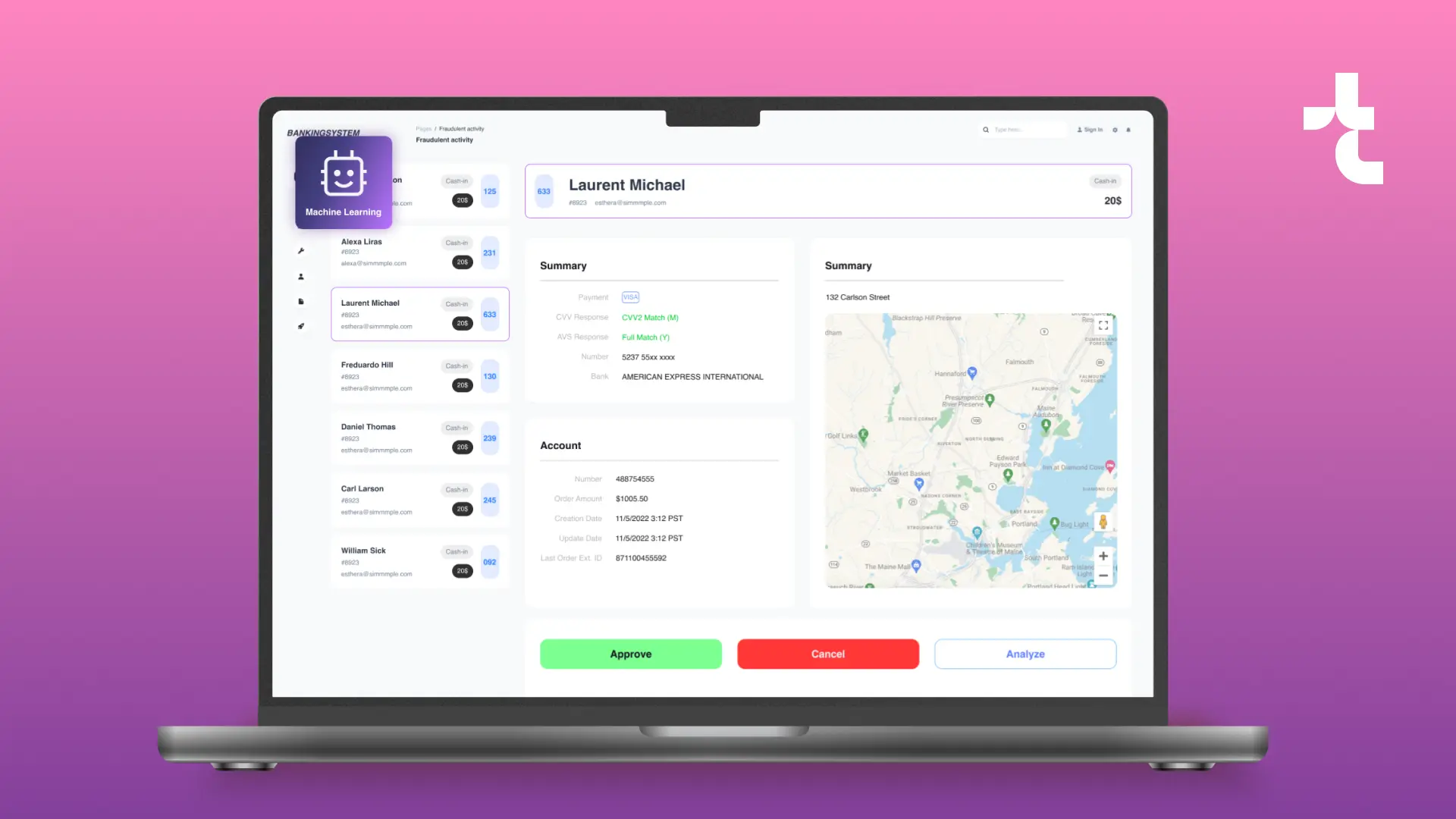

Our customer is a European software-as-a-service (SaaS) organization offering solutions for establishing and executing Know Your Customer (KYC), Know Your Business (KYB), and Anti-Money Laundering (AML) procedures in external services.

Project in numbers

1 year

5 specialists

efforts

11 520 hours

Team involved in the project

industry

Banking, Information Technology

solution

Identification app

Native Android (Kotlin), Native iOS (Swift), Cross-platform Flutter (Dart)/RN (JS)

1 x Web Developer

1 x Android Developer

1 x Product Manager

1 x QA specialist

1 x iOS developer

Challenge

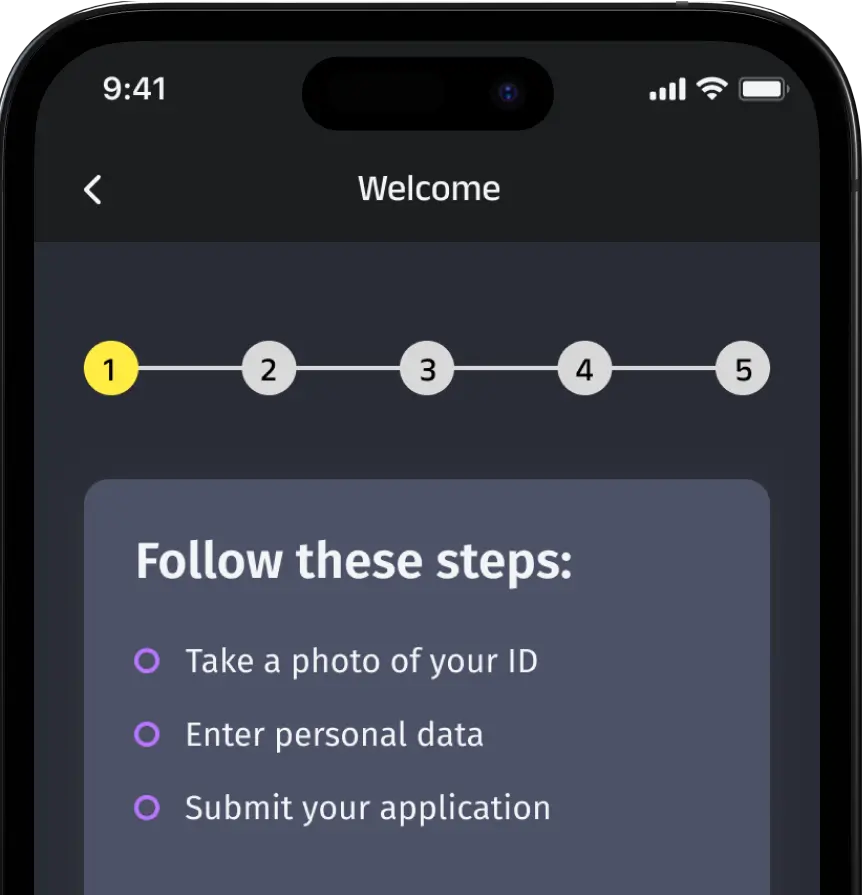

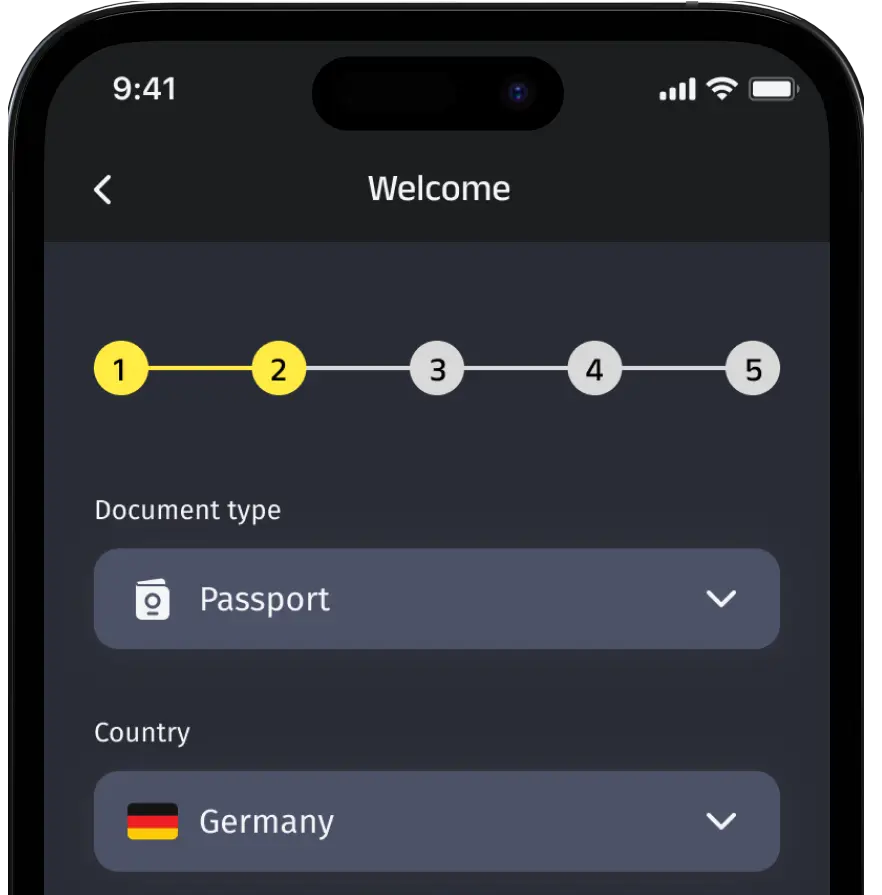

The main objective is to optimize the KYC framework for iOS and Android. The application had a slow validation process, and the web widget had restricted functionality. Therefore, it was not fully optimized for iOS and Android platforms. Our team was assigned to upgrade the KYC library and enhance the critical authentication capabilities.

Related objectives

Address issues with Android and iOS SDKs

Leverage unclear documentation for Nexus ID Check

Leverage documentation for the web version

Redesign and optimize the framework architecture

Solution & functionality

Our team collaborated closely with the customer to guarantee a smooth integration of SDKs into the new multi-platform application and native applications. We successfully improved the Nexus ID Check system, reorganized the library structure and framework for Android and iOS, and included a new library.

Redesigned architecture and improved functionality

Our experts have optimized the Nexus ID Check capabilities on Android and iOS platforms. We updated the system by eliminating redundant screens and conducted UI refinements. The updates resulted in faster and more user-friendly verification processes.

Thanks to redesigning the mobile framework, we reduced the time for implementing new features by 30% and simplified code maintenance. Furthermore, we introduced guidelines for integrating React Native and Flutter, facilitating the use of this library in future cross-platform solutions.

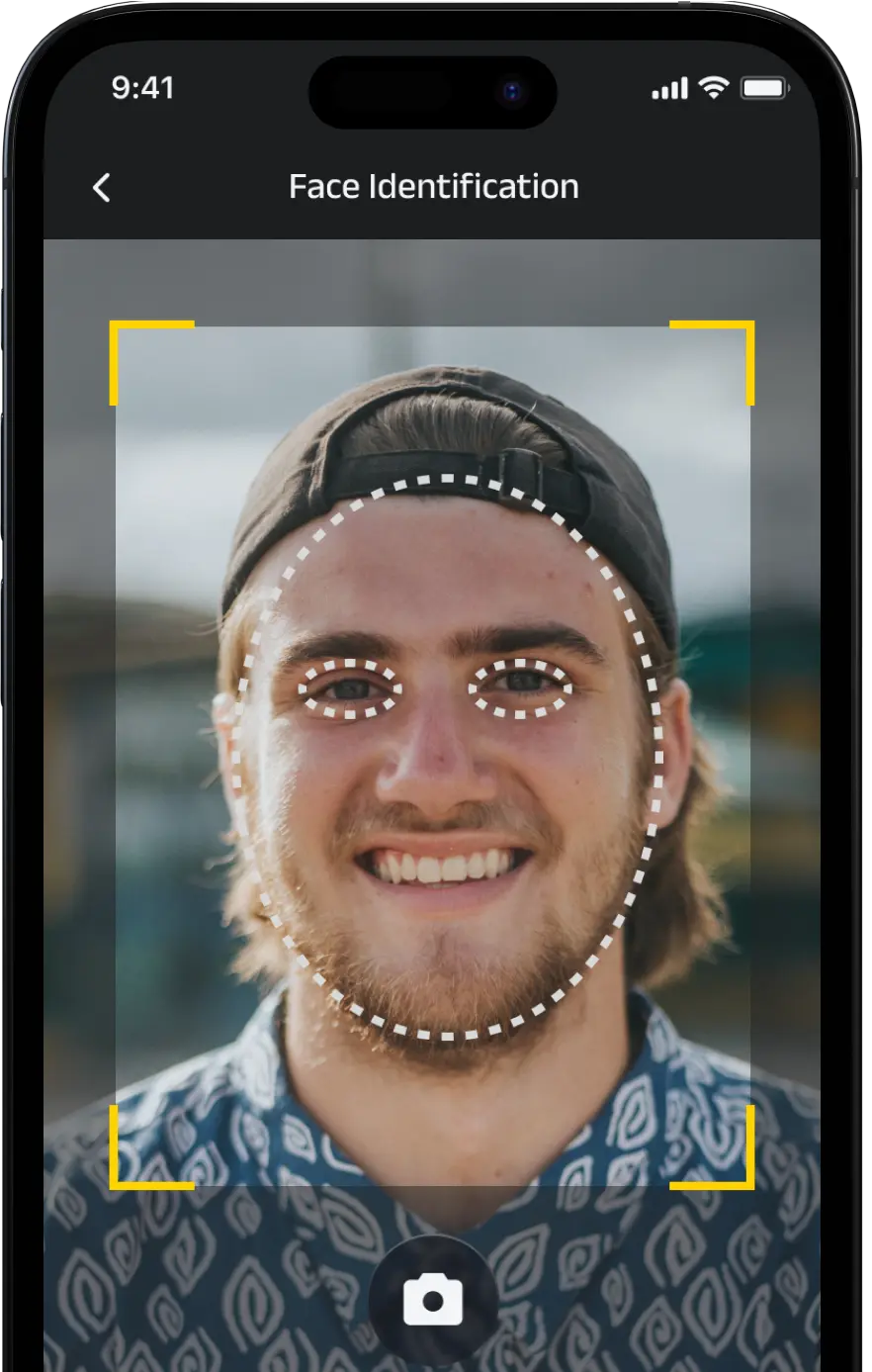

New FaceTec SDK for enhanced 3D biometrics

Before the update, our facial recognition software supported only regular recognition methods. Users had to capture multiple photos of their faces from different angles. The 2D images were sent to the Nexus ID Check server for further processing.

Our team seamlessly integrated an upgraded FaceTec SDK library to boost biometric processing. With FaceTec, the biometric data collection process has become more user-friendly and less time-consuming. The interface provides clear instructions for users, simplifying the scanning procedure and getting high-quality biometric data. When acquired, the data is processed and validated on the server’s side.

Besides optimizing the scanning and verification processes per se, our team enhanced the image quality, which led to more accurate user identification.

Optimized document verification solution

Previously, users could only add supporting documents on mobile devices by taking a photo in real time using their phone camera. However, we have now implemented a new function that allows users to take pictures in any convenient screen orientation, add various documentation types, and upload documents directly from their phone gallery in multiple formats, including PDF. This enhancement simplifies the verification process for users as they no longer need to keep physical documents on hand to take photos each time they log in.

Instant document verification and user identification

Before optimization, users were limited to adding supporting documents on mobile devices through real-time photo capture with their phone cameras. With the new feature, users are enabled to take photos in any suitable screen orientation and easily upload various document types directly from their phone gallery in multiple formats, including PDF.

With biometric data and supporting documents, users had to upload them every time they logged into the application. An instant user identification system allows users to log in quickly using a simple face scan. The uploaded selfies are instantly verified against verified 3D biometrics and other data stored in the backend system. Users are free from the need to re-upload documents and biometric data each time they log in.

Results and business value

The resulting cross-platform app now has a wide array of features aimed at enhancing KYC (know your customer), KYB (know your business), and AML (anti-money laundering) functionalities:

Innovative face biometrics capture

Easy data upload for the users

Enhanced data collection on the user’s geolocation

Enhanced accuracy and verification process

The system architecture and functionality of the KYC solution on mobile devices was refined with the advanced FaceTec SDK library and incorporated 3D biometrics. The team enhanced both the verification process and the user interface.

Related cases

Need assistance with a software project?

Whether you're looking for expert developers or a full-service development solution, we're here to help. Get in touch!

What happens next?

An expert contacts you after thoroughly reviewing your requirements.

If necessary, we provide you with a Non-Disclosure Agreement (NDA) and initiate the Discovery phase, ensuring maximum confidentiality and alignment on project objectives.

We provide a project proposal, including estimates, scope analysis, CVs, and more.

Meet our experts!

Viktoryia Markevich

Relationship manager

Samuel Krendel

Head of partnerships