E-payment platform

Mobile Banking App Development: Applications as a Digital Wallet

Our team developed iOS and Android applications from the ground up, with instant payment functionalities (P2P, C2B, B2B) and banking account management.

#Banking

#MobileDevelopment

Client*

Our client is a large IT company providing software development and IT consulting services for businesses and organizations, selected as a general contractor for a government project, Therefore the government financial regulator acted as the end customer.

*We cannot provide any information about the client or specifics of the case study due to non-disclosure agreement (NDA) restrictions.

Project in numbers

duration

2+ years

team

12 specialists

efforts

10 000+ hours

Team involved in the project

industry

Banking, Information Technology

product

E-payment platform

technologies

6 x Developers

1 x Business analyst

1 x Project manager

2 x QA specialists

1 x Solution architect

1 x UX/UI Designer

Challenge

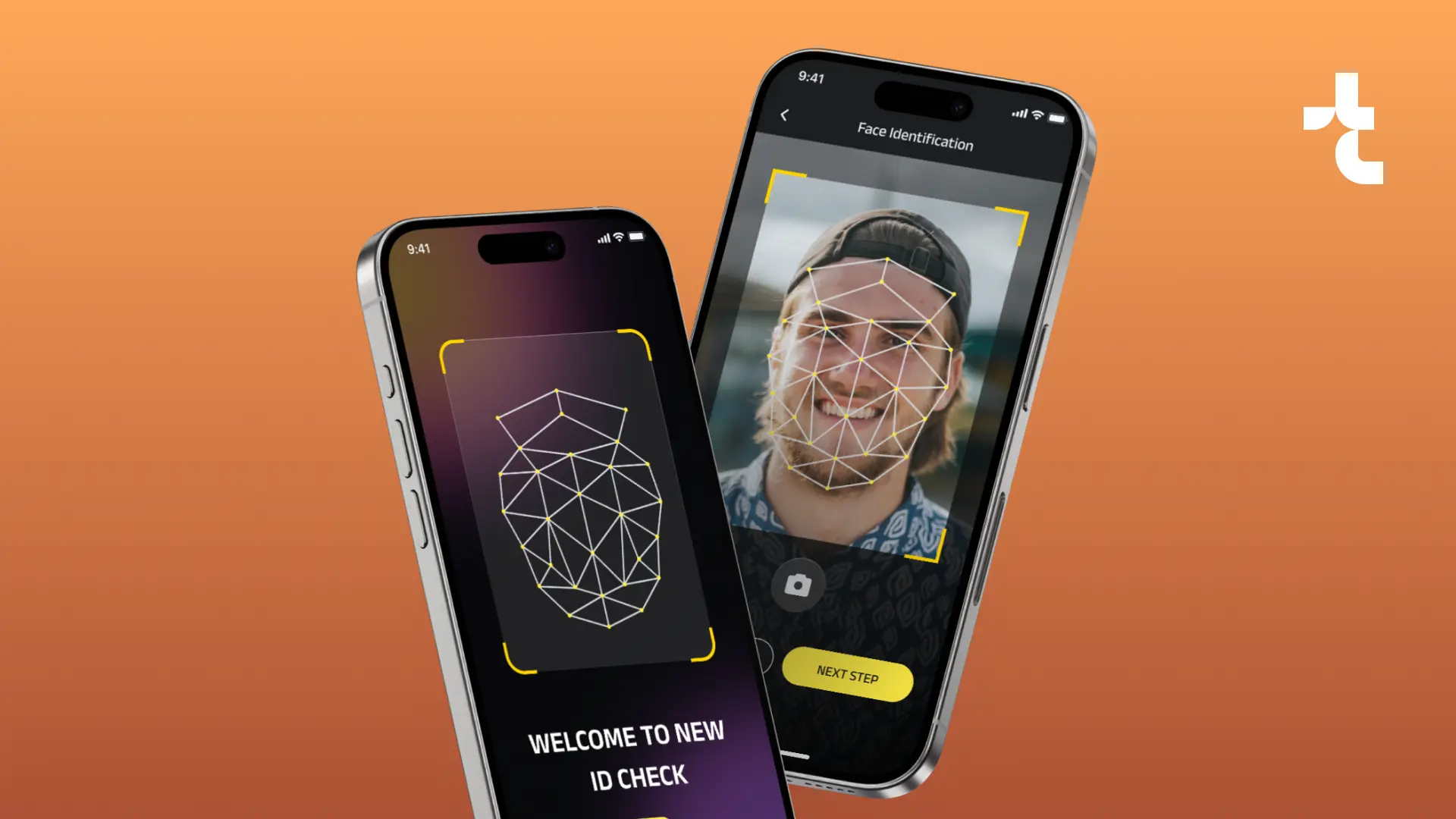

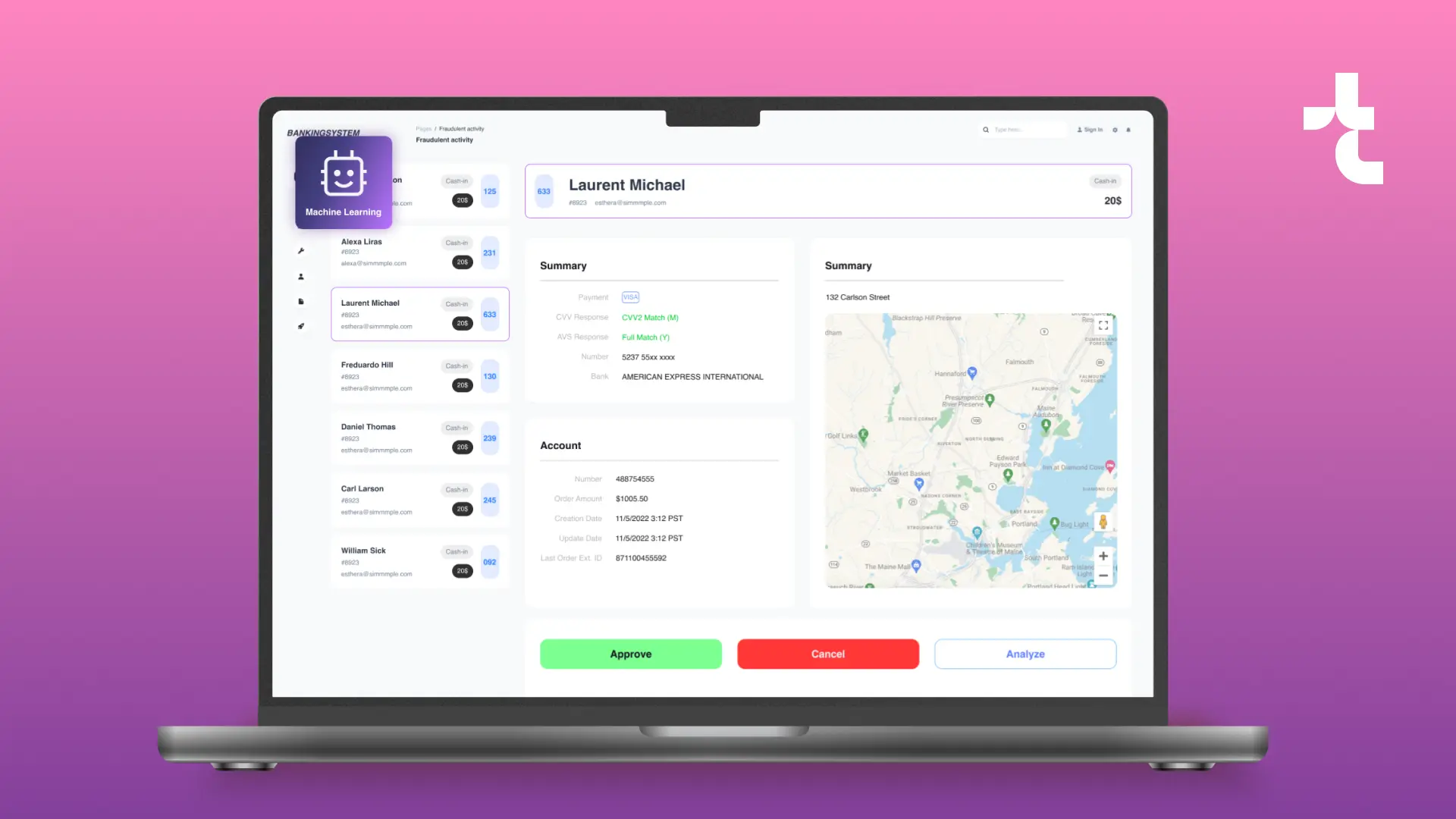

The major objective for the team was to create a transparent and easy-to-use digital system for instant electronic payments with modules for personal data security, fraud protection, and others.

Related objectives

Digital payment infrastructure

Availability of financial services

Resilient system security

Effective fraud detection

Solution & functionality

In order to protect confidential data, we integrated a multi-factor security system using data encryption, TLS 1.2, SSL Pinning, and checking for rooted devices. The processing itself is performed by a third party.

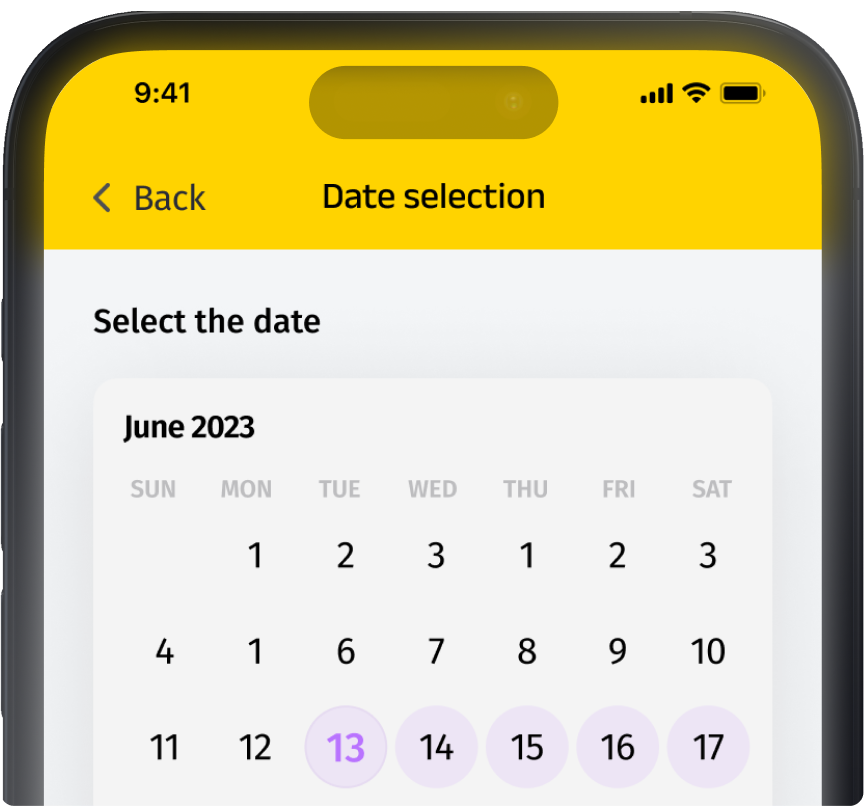

Smooth user experience

As it was crucial to guarantee an immersive user journey, we backed the smartphone solution with a range of essential characteristics and capacities.

Our development team has enhanced the mobile application with extensive payment options. Users can make transfers and payments (via QR codes as well) on an account-to-account basis by account number, email or mobile phone number. Individual and corporate users can replenish their accounts, as well as make requests for payment (for instance, to split the bill).

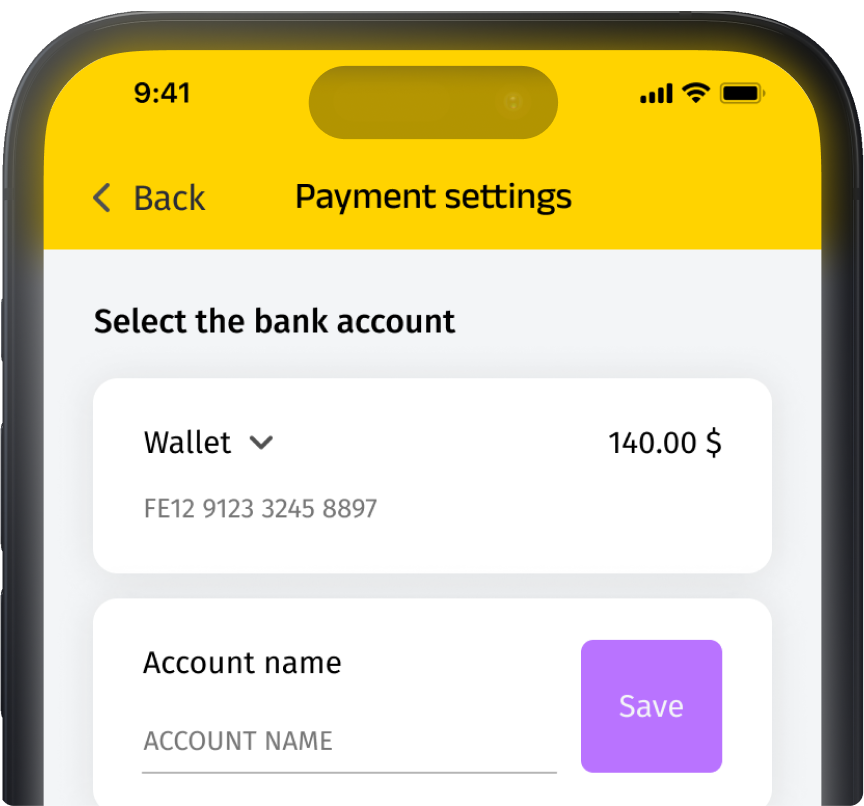

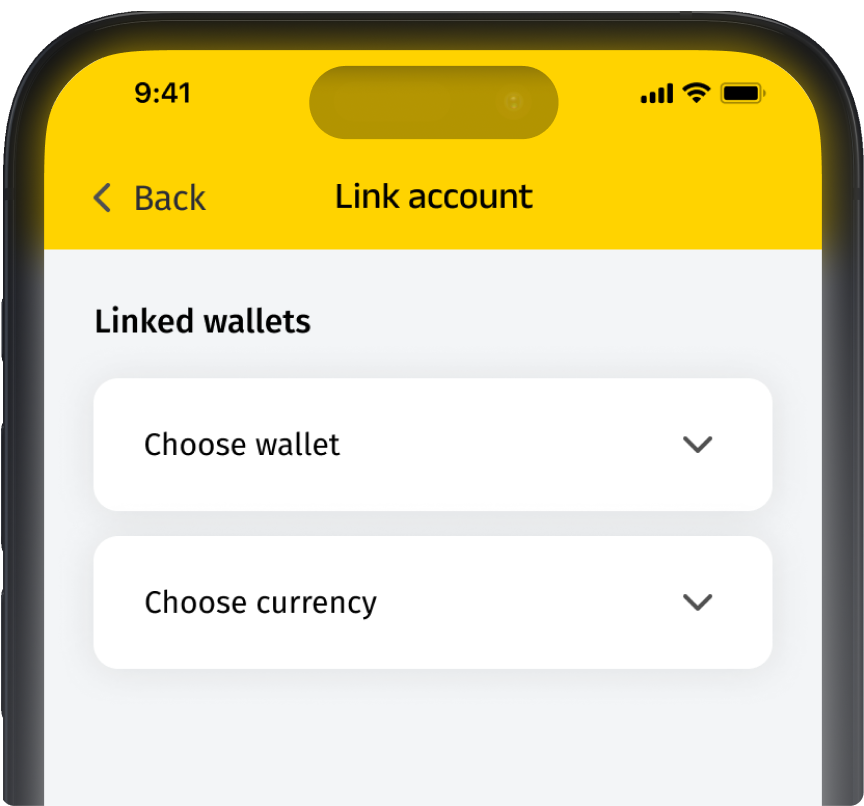

Digital wallet inside the application

To use the app, customers are required to connect their bank card/s and undergo the authentication process, providing details such as the bank’s name, account number/card information. The amount of cards the user can link, regional or foreign, is unlimited. After the registration and veri?cation process, users get access to the digital wallet.

Personalization

The app gives users flexibility and a range of personal budgeting features. Thus, it allows users to check the payments record, get detailed reports on incoming and outcoming transactions, set goals, and receive notifications to be on top of the spending limits.

Results and business value

The team implemented a user-friendly e-payment application ecosystem with integrated modules and launched iOS and Android apps within the set deadline. The final product was successfully used by citizens of the whole country and tourists.

System with top-level security

High-performing iOS and Android apps

User-friendly interface

Feature-rich functionality

Customer satisfaction

The team got positive feedback from both the customer and the end-user on the exceptional standard of development and efficiency of the app, as well as the effective communication throughout the project.